As blockchain technology continues to advance, the need for seamless communication between different networks becomes increasingly important. Quant’s Overledger network is a key solution in this context, driving interest in its native token, QNT. Here’s a detailed analysis of Quant’s price prediction, based on current market sentiment, technical analysis, and future forecasts.

Disclaimer: Please note that this is not investment advice. These are just our predictions, and we have no relation to the Quant development team.

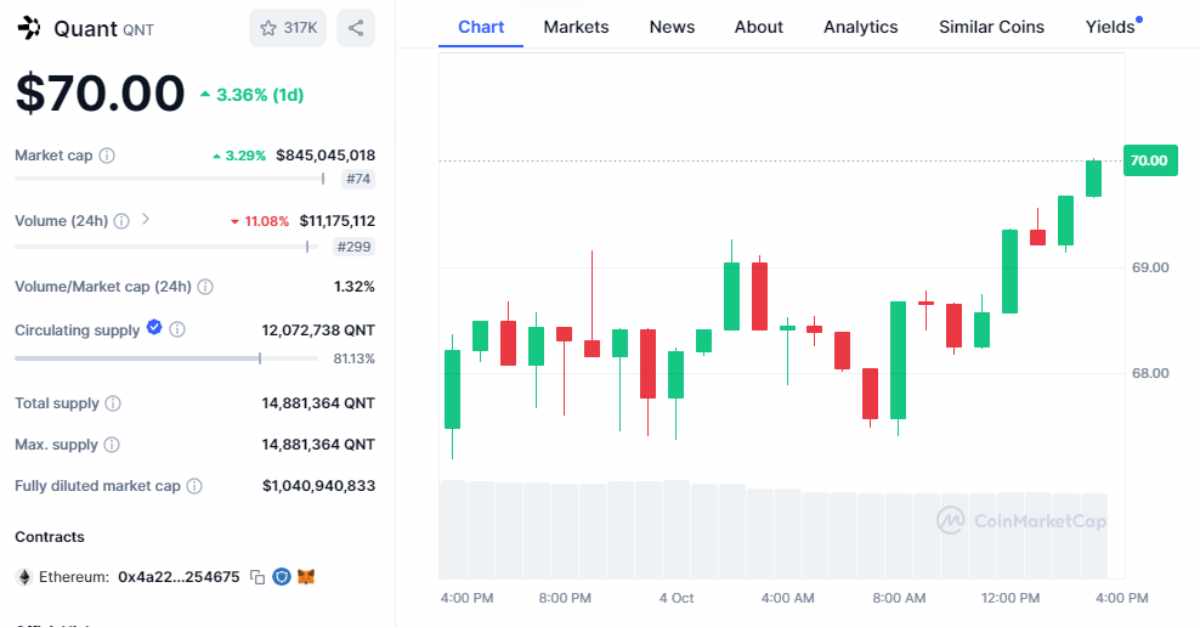

Quant Current Price

QNT is currently trading between $67.2 and $70 on October 4, showcasing the volatility of the cryptocurrency market. This fluctuation is typical in the digital asset market, where prices can rapidly shift due to factors such as market sentiment, trading volume, and broader market trends.

The market capitalization ranges from $811.41 million to $845.27 million, positioning Quant among the top 75 cryptocurrencies by market cap.

Market Sentiment

Overall, the sentiment surrounding Quant is largely positive, especially among long-term investors. The project’s focus on solving real-world problems, particularly in blockchain interoperability, has created a loyal base of supporters who view Quant as a crucial infrastructure layer for the future of decentralized finance (DeFi) and enterprise adoption.

However, short-term sentiment is more mixed. While some traders see price dips as buying opportunities, others remain cautious due to market volatility. On social media, discussions around QNT have been fueled by optimism about its technology, but tempered by the unpredictability of the cryptocurrency landscape.

Price Technical Analysis

Quantitative technical analysis involves using various technical indicators and chart patterns to predict future price movements in financial markets. One commonly discussed indicator is the MACD, which, according to recent posts, has shown a reversal on the weekly timeframe, signaling a potential bullish trend. Bollinger Bands, another tool frequently used by traders, are reported to be “squeezing,” which often precedes major price movements.

Support and resistance levels play a critical role in technical analysis, with resistance currently observed around $85, while key psychological and technical resistance levels might be around $100, $160, and even $280. Support is holding near $75, with additional support around $69 to $70, aligning with moving averages and past price actions, making these levels crucial for future trend direction.

QNT Price Predictions

Short-Term (2024)

In the short term, Quant’s price predictions for 2024 show a wide range. Analysts suggest that QNT could reach around $68.63 on the conservative end. However, there is considerable optimism that if market conditions remain favorable, the token could surge as high as $250. The key drivers for this growth would be increased adoption of Quant’s Overledger network, growing interest in interoperability solutions, and positive market sentiment toward blockchain technologies.

Mid-Term (2025-2026)

Looking further ahead, the outlook for QNT becomes even more promising. By 2025, some market forecasts suggest that QNT could rise to $500. This mid-term prediction is largely driven by anticipated developments in blockchain technology, including Quant’s potential role in future decentralized applications (dApps) and digital finance solutions. This target could be achievable if the Overledger network continues to gain traction and forms partnerships with major enterprises.

Long-Term (2030 and Beyond)

In the long term, price predictions for QNT take a more speculative turn but remain highly optimistic. Analysts foresee that if Quant continues to establish itself as a leader in blockchain interoperability, the token could soar to prices ranging from $1,251 to $2,500 by 2030. However, this growth hinges on the token’s ability to maintain relevance in the evolving blockchain space and the wider adoption of its technology across industries.

Conclusion

Quant’s native token, QNT, stands at the forefront of blockchain interoperability, which is vital for the future of decentralized technologies. While price predictions for QNT vary, ranging from cautious to highly optimistic, its unique position in the market provides a strong foundation for potential growth.

Related: Can Ravencoin Reach $1? RVN Price Prediction 2024 – 2030