Bitcoin (BTC) and the broader crypto market are facing tough conditions, historically worsened by September’s seasonal struggles.

Kaiko researchers recently explored how potential U.S. interest rate cuts and other major economic events could impact Bitcoin. The following four charts offer insights into what may lie ahead for BTC.

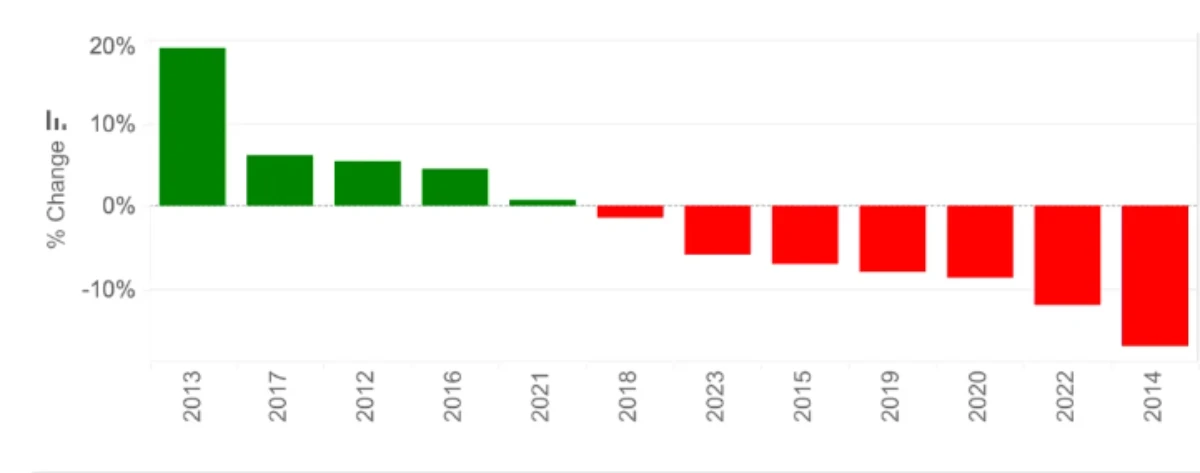

Bitcoin Price Performance in September

Historically, the third quarter is challenging for Bitcoin, with September often delivering the worst returns. In 2024, Bitcoin has already dropped 7.5% in August and 6.3% in September, and it currently sits 20% below its all-time high of $73,500.

Despite this, an upcoming U.S. interest rate cut could provide a boost to risk assets like Bitcoin.

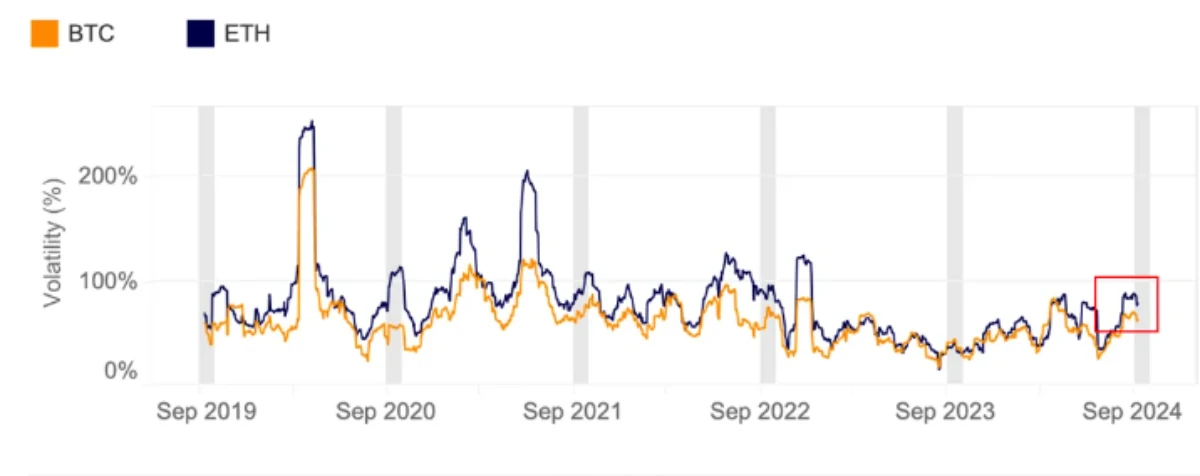

30-Day Historical Volatility

Bitcoin’s 30-day volatility has surged to 70%, nearly double last year’s figure, and is nearing the peak seen in March when BTC reached its all-time high. Ethereum has also seen significant volatility due to events like Jump Trading liquidations and the launch of Ethereum ETFs.

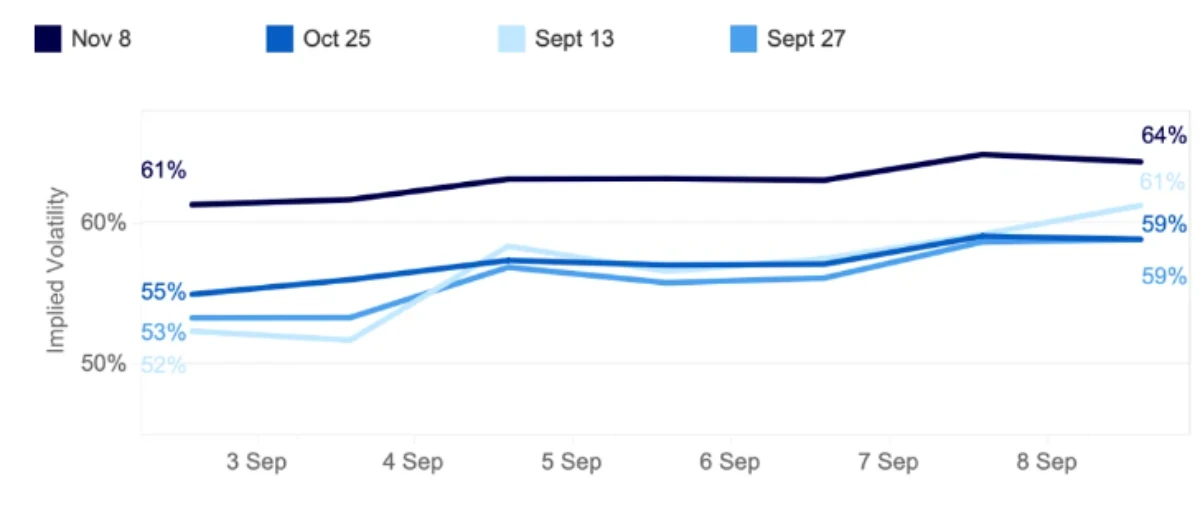

Implied Volatility Ahead of Expiry

Implied volatility (IV) for Bitcoin has been increasing since early September. Short-term options expirations, particularly the September 13 expiry, saw the biggest rise from 52% to 61%. When short-term IV exceeds long-term IV, it signals rising market tension, known as backwardation.

Risk managers often interpret this as a sign to reduce exposure to volatile assets.

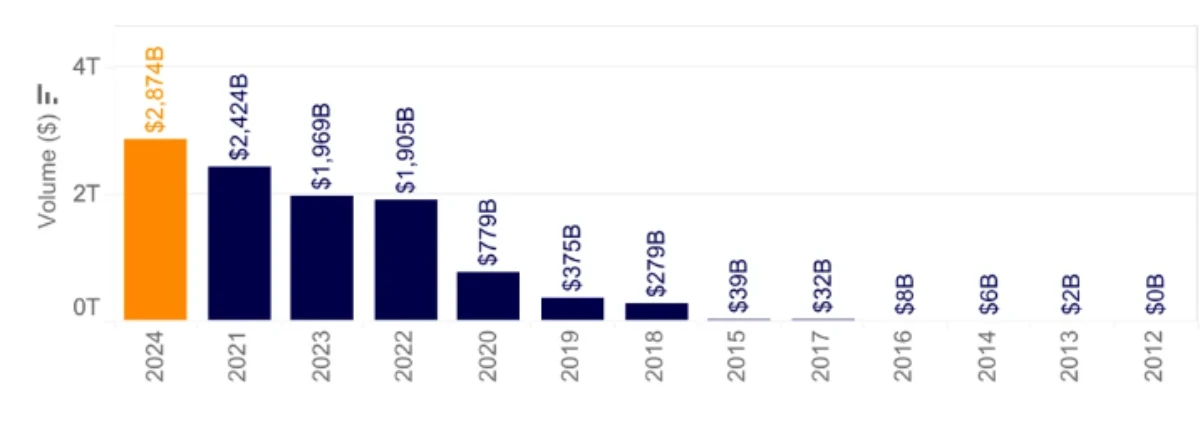

Trading Volume

Bitcoin’s trading volume is nearing a record $3 trillion, reflecting increased trader activity. While rate cuts are generally viewed as a positive catalyst for Bitcoin, there is concern that a larger-than-expected cut could trigger market uncertainty.

Additional factors like the upcoming U.S. elections may also contribute to volatility, with the Trump-Harris debate expected to influence Bitcoin and Ethereum markets.

Related news: Michael Saylor Predicts Bitcoin Could Reach $13 Million in the Next Two Decades