On September 7, 2024, the cryptocurrency market experienced unexpected volatility as the price of Bitcoin (BTC) dropped below the important $54,000 support level for the first time in a month. This caused concern among traders and investors.

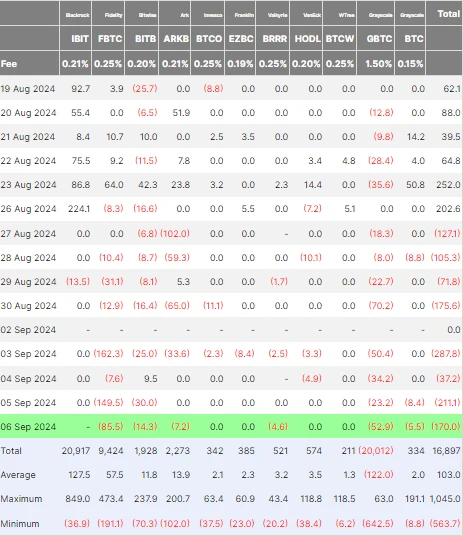

The drop in BTC price can be linked to a decrease in capital inflows into Spot BTC Exchange-Traded Funds (ETFs). Over the past two weeks, these funds have seen significant net withdrawals, which have weakened BTC’s price momentum. The situation worsened this week with net withdrawals exceeding $200 million on two separate days. On September 3, Spot BTC ETFs saw outflows of $287.8 million, followed by another $211.1 million on September 5.

The withdrawal trend has affected multiple ETFs. For example, BlackRock’s IBIT Fund has had eight consecutive trading sessions without new inflows, and Fidelity’s FBTC Fund has experienced significant outflows over the last six sessions. These developments are worrying for BTC ETF investors, especially since IBIT and FBTC had been leaders in capital inflows in the first half of 2024.

Since the launch of Spot BTC ETFs in the United States on January 11, 2024, there has been a strong correlation between BTC price movements and capital inflows into these ETFs. For instance, the increase in BTC prices during March and May of this year coincided with peak inflows into BTC ETFs. Conversely, the recent decline in capital inflows has caused a drop in BTC’s upward momentum.

Apart from ETF activity, seasonal trends in the crypto market are also impacting BTC’s price. Historically, the third quarter, especially September, has been the weakest for Bitcoin performance. The market’s low liquidity during the summer months has led to the well-known saying, “Sell in May and go away,” as traders anticipate a seasonal downturn.

September has been particularly tough for BTC, which has seen an average loss of 5.09% during the month. The cryptocurrency has experienced a six-year streak of consecutive declines in September, from 2017 to 2022. This trend has left little room for optimism among traders this year.

Despite the current challenges, investors may take comfort in historical patterns that suggest a better fourth quarter for the crypto market. Over the past years, Bitcoin has consistently bounced back in Q4, with an average performance of +88.84%. The expected increase in liquidity and optimism could drive BTC prices to new highs towards the end of the year.

In the short term, however, the market remains uncertain. Traders will closely monitor capital flows into BTC ETFs and seasonal trends to see if the current downturn is temporary or indicative of a longer-term trend. Regardless of the outcome, one thing is certain: Bitcoin’s rollercoaster ride continues.

Related news: Bitcoin’s Post-Halving Struggles: 2024 Performance Sparks Investor Concerns