Algorand (ALGO) is a blockchain platform designed to solve some of the most critical issues facing traditional blockchain technologies, particularly scalability, security, and decentralization. This article delves into Algorand’s current market standing, community dynamics, and price forecasts through 2030.

Disclaimer: Please note that this is not investment advice. These are just our predictions, and we have no relation to the Algorand development team.

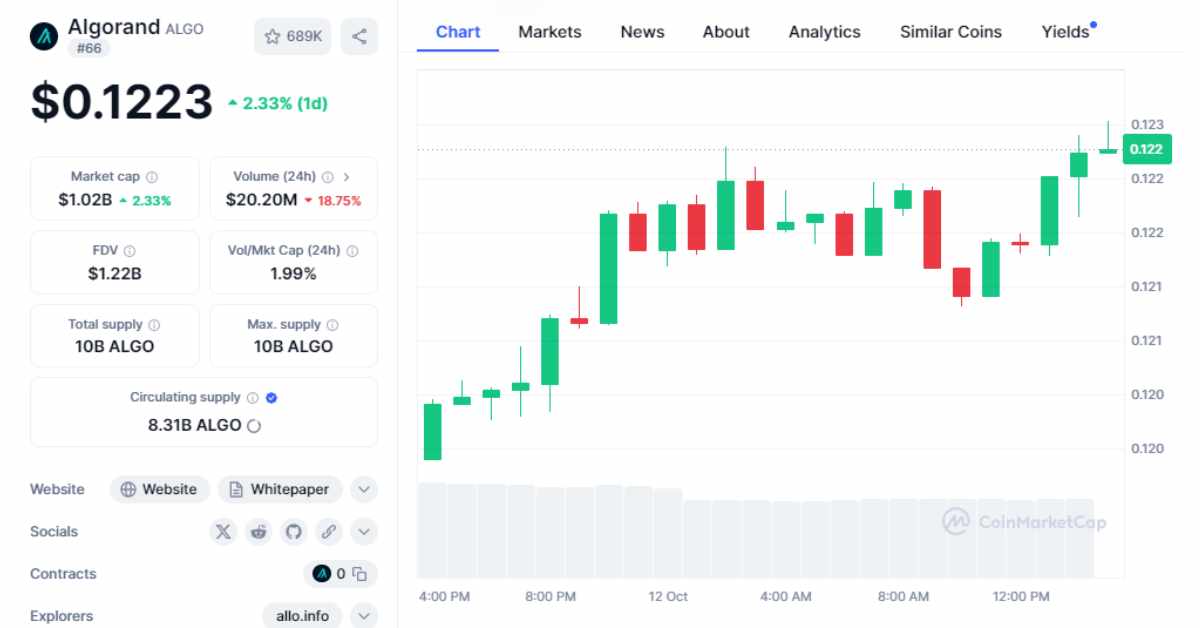

Current Price and Market Position

As of October 12, Algorand is trading between $0.1194 and $0.1225, showing a 2.33% increase in the last 24 hours but a 3.64% decrease over the past week. With a market capitalization ranging between $992.57 million and $1.02 billion, ALGO ranks 66th on CoinMarketCap. Despite its recent volatility, ALGO’s 24-hour trading volume remains robust at $20.20 million.

Community Sentiment

The Algorand community has expressed concerns over recent governance measures, particularly about the allocation and reduction of governance rewards. Many community members are frustrated with what they see as a lack of transparency from the Algorand Foundation regarding the reallocation of funds and the reasoning behind the potential reduction of rewards. These concerns have sparked fears of a sell-off, as reduced liquidity and lower incentives may drive some users away.

Critics outside of the Algorand echo chamber argue that the project’s technological strengths are not matched by its market performance and visibility. However, there is optimism regarding Algorand’s efforts to make its development environment more accessible, even if the initial focus on institutional users may have delayed wider adoption.

Technical Analysis

Technical Indicators:

- Relative Strength Index (RSI): The RSI suggests that ALGO is oversold, indicating the potential for a price correction or rebound.

- Moving Averages (MA): Various moving averages also point to a bearish signal, with the current price below key averages.

- Oscillators: Mixed signals from oscillators like the Commodity Channel Index suggest caution, but the overall sentiment leans toward a bearish outlook.

Support and Resistance Levels:

- Short-Term Support: ALGO’s immediate support lies between $0.115 and $0.122, acting as a potential floor if prices continue their downward trend.

- Long-Term Support: A critical support level is at $0.090, which could be tested if negative momentum persists.

- Short-Term Resistance: The nearest resistance level stands at $0.15–$0.154, which could cap any near-term upward movement.

- Higher Resistance: In a more bullish scenario, resistance at $0.334–$0.338 and $0.40–$0.417 could come into play if there’s a significant rally.

Algorand Price Prediction

| Year | Bearish | Bullish | Average |

| 2024 | $0.122 – $0.128 | $0.138 | $0.130 |

| 2025 | $0.130 | $0.232 | $0.175 |

| 2026 | $0.107 | $0.3736 | $0.24 |

| 2027 – 2030 | $0.083 | $1 | $0.55 |

2024 Prediction

- Bearish Scenario: Continuing bearish trends could see ALGO hovering around $0.122, with possible lows at $0.128 by December.

- Bullish Scenario: With favorable market conditions and technological advancements, ALGO could push up to $0.138 by the year’s end.

- Average Scenario: If the market stabilizes, ALGO may trade around $0.130 throughout 2024.

2025 Prediction

- Bearish Scenario: ALGO could start the year at $0.130, dropping to as low as $0.107 if market conditions remain challenging.

- Bullish Scenario: Strong ecosystem growth, particularly in Algorand Standard Assets (ASA) and partnerships, could push ALGO to $0.232 by year-end.

- Average Scenario: ALGO might average around $0.175, reflecting steady growth.

2026 Prediction

- Bearish Scenario: Market hesitations or regulatory challenges could see ALGO trading as low as $0.107 by 2026.

- Bullish Scenario: With successful technological advancements, ALGO could climb to $0.3736, showing confidence in the network.

- Average Scenario: A moderate price increase could result in ALGO averaging around $0.24.

2027 – 2030 Prediction

- Bearish Scenario: Prolonged market fatigue might see ALGO prices stabilizing or declining to $0.083 by 2029.

- Bullish Scenario: Significant adoption and breakthroughs could propel ALGO to $1 by 2030.

- Average Scenario: Assuming steady growth, ALGO may average around $0.55 by 2030, driven by consistent but gradual progress in the blockchain space.

Conclusion

Algorand’s future price will depend heavily on its ability to navigate governance concerns, improve community sentiment, and drive technological adoption. While bearish scenarios suggest caution in the near term, the project’s long-term potential remains optimistic, particularly if it can leverage its technological strengths and increase market visibility.