On August 20, Binance released a noteworthy article about user asset management in the first 7 months of 2024.

During this period, Binance’s risk management system prevented over $2.4 billion from being lost in scams and fraud by 1.2 million users.

Of this amount, approximately $1.1 billion, which equates to about 45% of the total, was related to suspicious cryptocurrency withdrawals. This achievement is attributed to Binance’s effective risk management measures in detecting and flagging suspicious transactions on the platform.

Binance CEO Richard Teng shared the article on his Twitter account. Since taking over from former CEO Chapeang Zhao (CZ), Teng has performed admirably in his role.

In the first 7 months of 2024, #Binance prevented $2.4B in potential user losses. 🤯

How? A hybrid approach of AI & manual reviews allows us to detect suspicious transactions and take quick action to protect users.

Always user-focused! More details here. ⤵️…

— Richard Teng (@_RichardTeng) August 20, 2024

Binance’s risk monitoring system comprises 8 levels of operations, covering areas such as P2P trading, payments, and withdrawals.

The system utilizes a blend of manual and AI-based assessments to monitor risks in real-time. Some of Binance’s notable security features include direct user contact for confirming suspicious transactions, implementing waiting periods before executing sensitive transactions, and freezing abnormal fund flows to prevent Ponzi schemes.

Rohit Wad, the CTO at Binance, emphasized that prioritizing users has always been Binance’s focus, which drives the company to build and uphold industry-leading technology tools and processes to safeguard users and their assets round the clock.

Wad also stated that Binance will continuously strive to prevent bad actors from exploiting cryptocurrency exchange vulnerabilities. As of July 31, Binance has safeguarded over $73 million in funds for third parties in addition to protecting its platform.

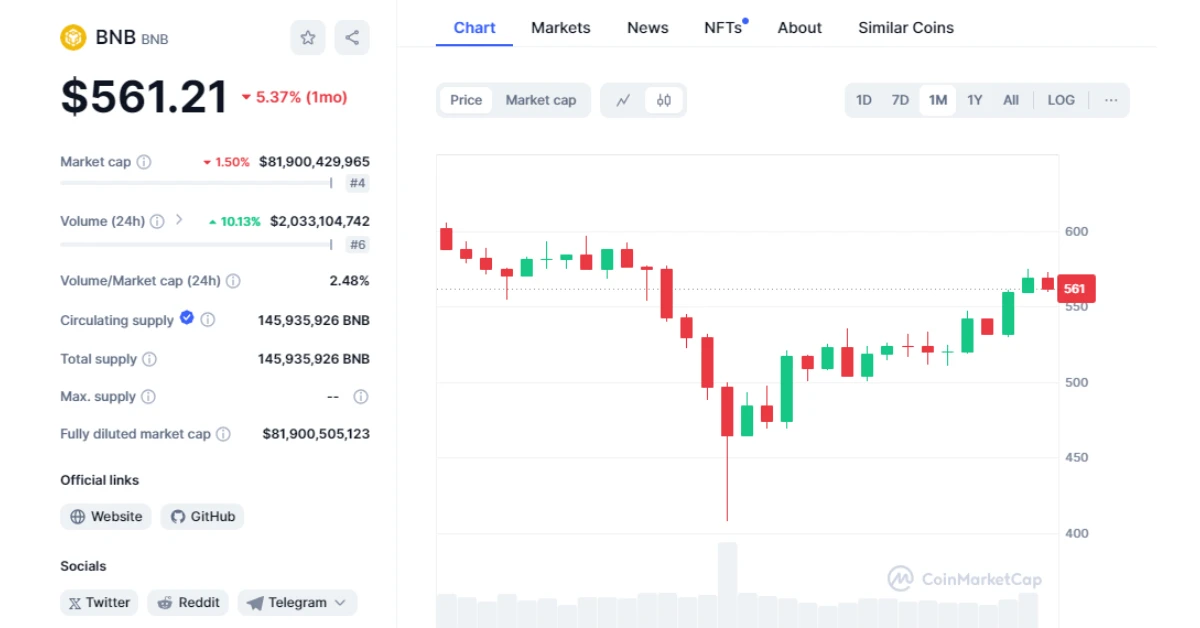

With its ongoing development, the BNB token has surged by almost 30% from its lowest point in August.

On the monthly chart, BNB’s price exhibited a significant candlestick formation, experiencing only a 2% decline from the $576 price at the beginning of the month. Currently, BNB is trading around $561, marking a marginal 1% decrease in the last 24 hours.

Related news: Binance Launches 57th Launchpool Project Dogs (DOGS)