The cryptocurrency market started the new week with declining prices across all crypto coins.

On August 5, Bitcoin’s price fell nearly 20%, dropping from approximately $60,000 to below $50,000. Ethereum experienced an even sharper decline of over 20%, falling from $2,800 to $2,200.

Similarly, leading memecoins saw significant drops: PEPE fell 24%, SHIB fell 20%, and DOGE fell 21%.

This decline in the crypto market is attributed to strong selling pressure amid fears of a global financial recession.

According to pre-market data, US stock futures remain in the red. Japan’s Nikkei 225 index also plummeted by 4,400 points (12.40%) on the first day of the week, following a similar decline last Friday.

On August 2, the US announced that non-farm payroll data for July increased by only 114,000, much lower than the forecast of 185,000 and the previous month’s figure of 179,000. The US unemployment rate also unexpectedly rose to 4.3%, surpassing the forecast of 4.1%, marking the highest figure since October 2021.

These data have raised concerns among traders about a potential US economic recession, leading to the sharpest decline in US stock indexes since the COVID-19 pandemic began. Indexes such as the Dow Jones, NASDAQ, and S&P 500 all fell by nearly 3%.

Investors may have sold their crypto investments to reduce risks and shift to safer assets.

Another factor contributing to the sharp decline in the crypto market was the long squeeze pressure in the futures market.

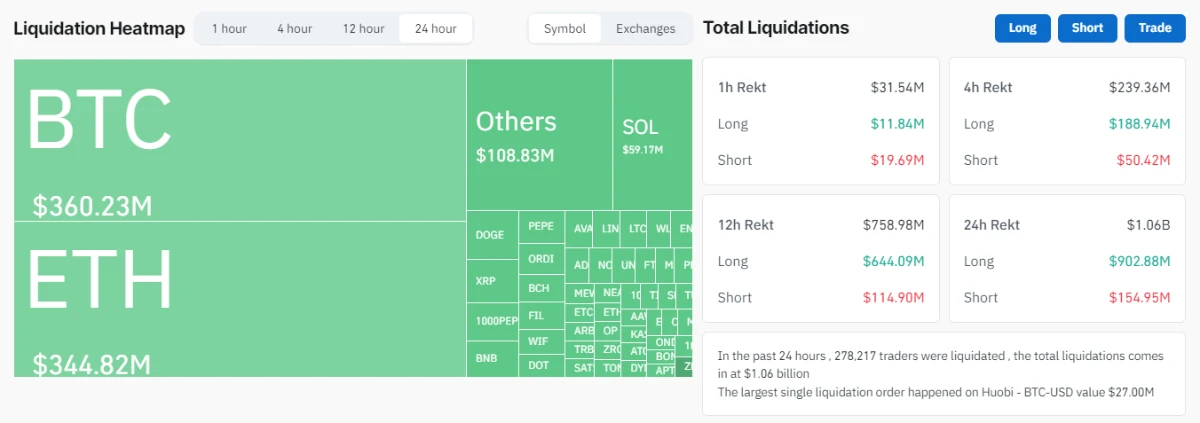

In the past 24 hours, up to $1.06 billion in futures orders (leveraged positions) were liquidated in the crypto market. Over 278,000 traders were liquidated, with the largest liquidation order occurring on the HTX exchange with a value of $27 million in the BTC/USD pair. Long orders accounted for the majority of liquidations in the past day, totaling $902 million, while more than $150 million in short orders were also liquidated.

Additionally, the crypto market recently faced selling pressure from the German government and the Mt. Gox exchange. Now, the lending platform Genesis has started money transfers to refund a total of over $4 billion to customers. Specifically, Genesis transferred a total of 32,256 BTC ($2.1 billion) and 256,775 ETH ($850 million) to various wallet addresses over the past three days.

Furthermore, market maker Jump Trading has withdrawn up to $500 million worth of ETH in the past week. On X (Twitter), the crypto community speculated that Jump Trading wanted to withdraw from market-making activities in the crypto market. Some comments suggested that the fund’s finances were in trouble after being caught by the CFTC, and Kanav Kariya, the president of Jump Crypto, decided to resign shortly after.

Related news: US Government’s Unexpected Move of $2 Billion in Bitcoin Causes Price to Drop Below $67,000