On August 1st, MicroStrategy – currently the world’s largest holder of BTC – released its financial results for Q2 2024, revealing an increase in its Bitcoin holdings.

According to the report, MicroStrategy stated that it had purchased an additional 169 BTC in July for $11.4 million, bringing its total Bitcoin holdings to 226,500 BTC at a total cost of $8.3 billion, averaging $36,821 per Bitcoin. Since the beginning of Q2, the company acquired 12,222 Bitcoin for $805.2 million, averaging $65,882 per Bitcoin.

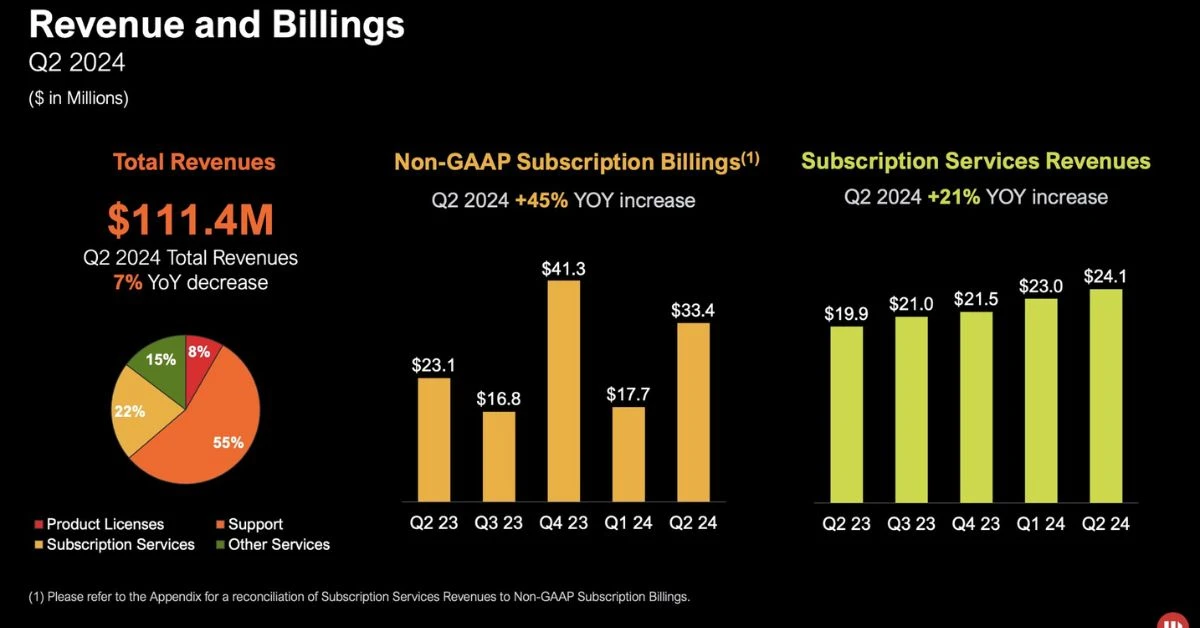

The report also indicated that in Q2, MicroStrategy raised $800 million by issuing Convertible Senior Notes with a 2.25% interest rate due 2032 and initiated a repurchase of $650 million of Convertible Senior Notes due 2025. The company also noted that subscription services revenue reached $24.1 million, up 21% year-over-year.

Additionally, MicroStrategy reported a significant loss of $5.74 per share on quarterly revenue of $111.4 million, a 7% decline year-over-year. Notably, the company disclosed a net loss of $123 million for Q2, slightly improving from a net loss of $137 million in the same period last year.

To measure the performance of its Bitcoin strategy, the company also revealed a new key performance indicator (KPI) called the “BTC Yield” — representing the percentage change over time in the ratio of the company’s Bitcoin holdings to the number of diluted shares outstanding. In simpler terms, this metric is designed to show the shareholder value created per unit of Bitcoin repurchased.

MicroStrategy stated that the company’s BTC yield currently stands at 12.2% year-to-date, and it aims for an annual yield of 4 – 8% from 2025-2027.

The company also confirmed that the 10:1 stock split – initially announced on July 11th – will officially take effect on August 7th.