ETF transaction fees are one of the key factors investors look at when deciding which ETF to buy. Since ETFs of the same type use the same underlying assets, like Bitcoin or Ethereum, the profitability of an ETF investment also depends on whether the fees are high or low.

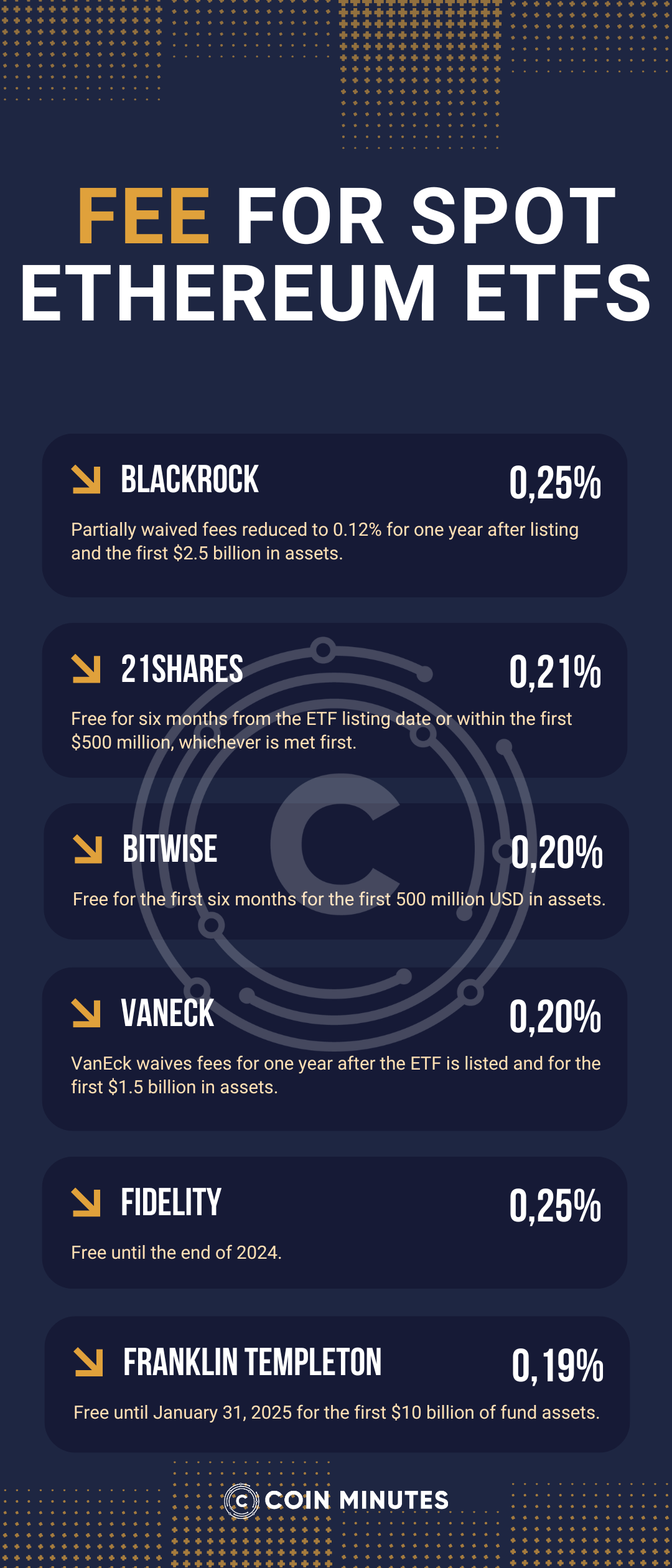

Asset management giant BlackRock is setting a 0.25% fee for its spot Ethereum product as firms gear up for an expected launch next week. According to an updated S-1 registration statement filed on Wednesday, BlackRock might “waive all or part” of this fee for specific times. Initially, they plan to reduce the cost to 0.12% for the first year after listing and for the first $2.5 billion in assets.

“The Sponsor’s Fee is accrued daily at an annual rate of 0.25% of the Trust’s net asset value and is payable at least quarterly,” BlackRock stated in the amended form. “The Sponsor can waive all or part of the fee at its discretion for specified periods.”

ETF issuer 21Shares set a 0.21% fee, which will be waived for six months or until the first $500 million in assets, whichever comes first, according to their amended S-1 filed on Wednesday.

Bitwise also announced its fee on Wednesday, setting it at 0.20%. They had previously stated that the sponsor fee would be waived for the first six months on the first $500 million in assets.

Grayscale set its fee for the Grayscale Ethereum Trust at 2.5%, much higher than the others. Ten percent of Grayscale’s spot Ethereum ETF will form an Ethereum mini trust, providing $1 billion in seed funding.

Invesco Galaxy’s fee is 0.25%, VanEck’s is 0.20%, and Franklin Templeton set a 0.19% fee. Fidelity set its fee at 0.25% but will waive it through the end of 2024. Franklin Templeton will waive its fee until January 31, 2025, on the first $10 billion of the fund’s assets. VanEck will waive its fee for a year after listing for the first $1.5 billion.

Several sources indicate that spot Ethereum ETFs are set to start trading on July 23.

“SEC finally got back to issuers today, asking them to return final S-1s on Wednesday (including fees),” Senior Bloomberg ETF analyst Eric Balchunas posted on X Monday. “Then they’ll request effectiveness on Monday after the close for a Tuesday 7/23 launch.”

Hester Peirce saying what we thought but nice to hear it directly: both staking and in-kind creation/redemption for eth/btc ETFs are “open for reconsideration” (if there’s a change at POTUS obv). https://t.co/sqAmL878LE

— Eric Balchunas (@EricBalchunas) July 17, 2024

Firms have been pushing to get the U.S. Securities and Exchange Commission’s approval for their Ethereum products and are now nearing the finish line. This follows the SEC’s approval of 19b-4 forms for eight spot Ethereum ETFs on May 23. Issuers will need their registration statements to be effective before they can launch.

Why Is Staking Important in Spot Ethereum ETFs?

A spot Ethereum ETF is an investment fund that holds actual Ethereum rather than just tracking its price. Investors buy shares of the ETF, and the fund owns the ETH on their behalf. When a spot Ethereum ETF includes Staking, the fund takes the ETH it holds and stakes it on the Ethereum network. By doing this, the ETF earns staking rewards.

Example: Imagine you buy shares in a spot Ethereum ETF that includes Staking. The ETF takes the ETH it holds and stakes it. Over time, it earns rewards in ETH, which are then added to the fund’s assets. As a result, the value of your ETF shares could increase more than if the ETH was just held without Staking.

Staking is a critical concept in the crypto world, and including it in spot Ethereum ETFs could bring several benefits.

- Boosting Returns: Staking allows investors to earn rewards by locking up their Ethereum. When Ethereum is staked, it helps secure the network, and in return, investors receive additional ETH as a reward. This can boost the overall returns of the ETF, making it more attractive to investors.

- Network Security: By staking Ethereum, investors contribute to the security and stability of the Ethereum network. A more secure network benefits everyone involved, from individual investors to large institutions.

- Investor Confidence: Allowing staking in spot Ethereum ETFs can increase investor confidence. It shows that the ETF is actively contributing to the network and leveraging the full potential of Ethereum.

- Regulatory Signals: Including Staking could signal to regulators that the crypto industry is maturing and capable of self-regulation. It demonstrates a commitment to network security and investor returns, which could help gain broader acceptance.

Previously, spot Ethereum ETF eliminated staking to efficiently meet the SEC’s terms, thereby making the ETF approval process more accessible and helping Ethereum ETF access large cash flows and many investors. More private.

Related news: Analyst Predicts Spot Ethereum ETFs Just Capture 30% of Bitcoin ETF Inflows