According to CoinDesk, the U.S. Securities and Exchange Commission (SEC) has informed Ethereum ETF issuers that trading can commence next Tuesday (July 23).

In late May, the SEC approved Ethereum ETF proposals from major Wall Street players like BlackRock, Fidelity, and VanEck. However, a specific start date for trading still needed to be set. Since then, issuers have finalized their S-1 forms for official SEC approval. So far, only VanEck, Invesco, and Galaxy have disclosed specific trading fees.

To meet the SEC’s deadline, issuers must resubmit their S-1 forms by this Wednesday (July 17). Bloomberg ETF analyst Eric Balchunas confirmed this information in an X (Twitter) post.

Update: Nate’s instincts were right, hearing SEC finally gotten back to issuers today, asking them to return FINAL S-1s on Wed (incl fees) and then request effectiveness on Monday after close for a TUESDAY 7/23 LAUNCH. This is provided no unforeseeable last min issues of course! https://t.co/D21FD9Qf94

— Eric Balchunas (@EricBalchunas) July 15, 2024

The crypto community is buzzing with excitement and optimism about the market. They believe Ethereum ETFs could reach record milestones similar to the Bitcoin spot ETFs earlier this year.

Contrary to this optimism, Citigroup experts are more cautious. They predict that U.S. Ethereum spot ETFs might attract only 30-35% of the $16.1 billion that has flowed into Bitcoin spot ETFs since their inception.

Based on this estimate, Ethereum spot ETFs could attract between $4.7 billion and $5.4 billion in the first six months. This is more than a 50% increase from the $3.1 billion to $4.8 billion forecasted by K33 Research in June.

Challenges Facing Ethereum ETF Compared to Previous Bitcoin Spot ETF Success

Financial analyst Alex Saunders from Citigroup suggests that despite the market’s high excitement, investments flowing into Bitcoin ETFs are unlikely to meet expectations. This is attributed to three key reasons:

- Unclear differentiation between spot Bitcoin ETF and spot Ethereum ETF: Investors often must distinguish prominently between spot Bitcoin ETF and spot Ethereum ETF. This results in funds shifting from Bitcoin ETF to Ethereum ETF rather than attracting new investments from new investors. This is partly because Ethereum and Bitcoin share technological similarities and functionalities, with Ethereum focusing on smart contracts and Bitcoin serving as a store of value.

- Lack of staking features in spot Ethereum ETF: Another factor is the absence of staking features in spot Ethereum ETF. Staking allows Ethereum holders to participate in supporting the network and earning income by holding and operating Ethereum. This feature is necessary to ensure Ethereum’s appeal to investors interested in sustainable income from cryptocurrency holdings.

- First-mover advantage of Bitcoin in ETF products: Bitcoin was the first cryptocurrency to be traded as a spot ETF product. The approval of spot Bitcoin ETFs attracted a significant influx of new capital into the cryptocurrency market. While the SEC approved spot Ethereum ETFs in May 2024, they inevitably face comparisons with Bitcoin, which had already set a precedent and caused a subsequent market impact.

Given these factors, investors might need more time to pour money into a similar ETF product shortly.

However, these expert predictions could be off. The launch of spot Ethereum ETFs coincides with a more dovish stance from the Federal Reserve, which has held interest rates steady for the seventh time, potentially leading to future rate cuts. The stock market is also rising, and the USD is weakening, creating a favorable environment for a solid crypto growth surge.

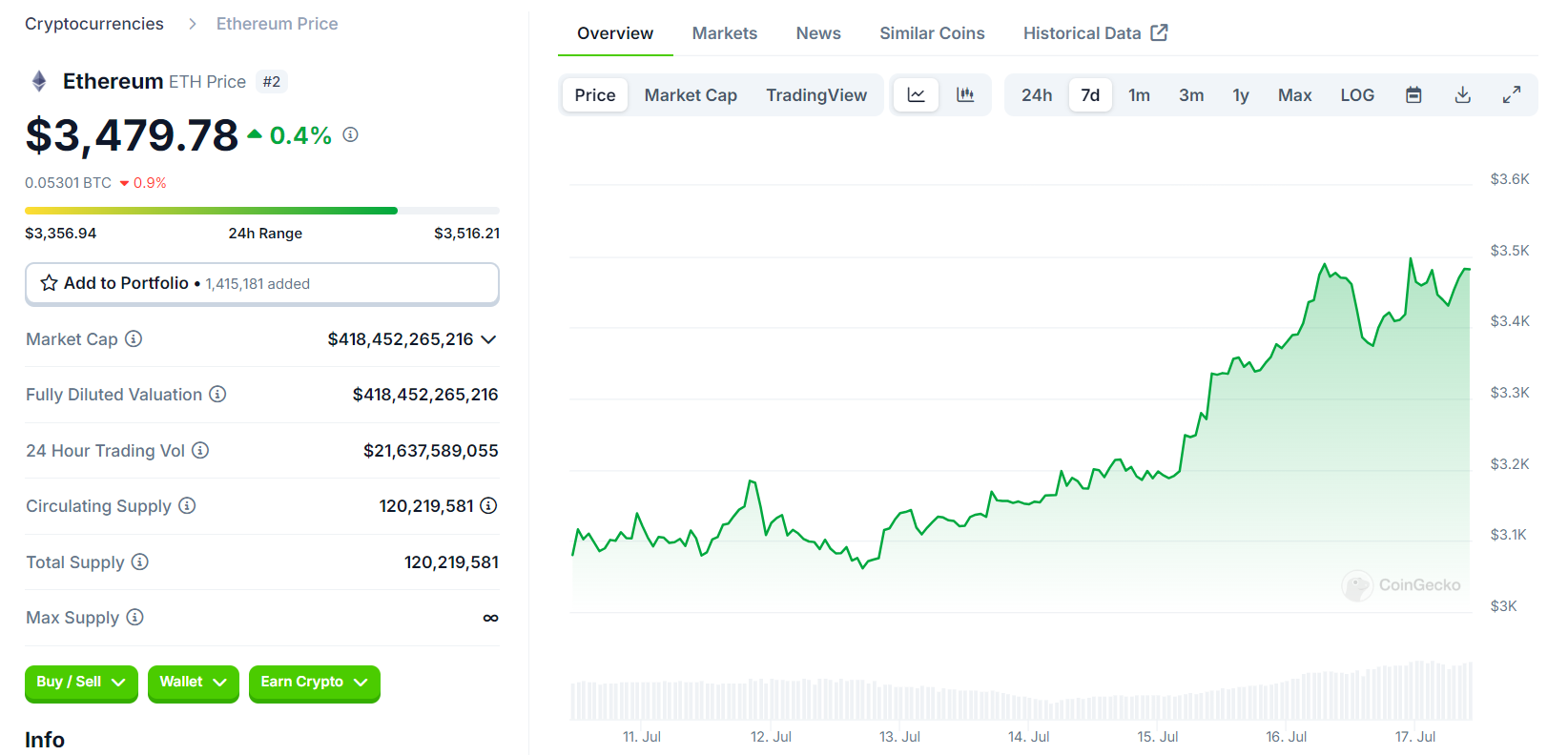

ETH is trading around $3,410, up more than 2% in the past few hours, thanks to the news that Ethereum ETFs could start trading next week.