After several days of market anxiety triggered by the German government selling BTC and Mt. Gox starting to repay creditors, a positive signal has emerged, rekindling investor hope.

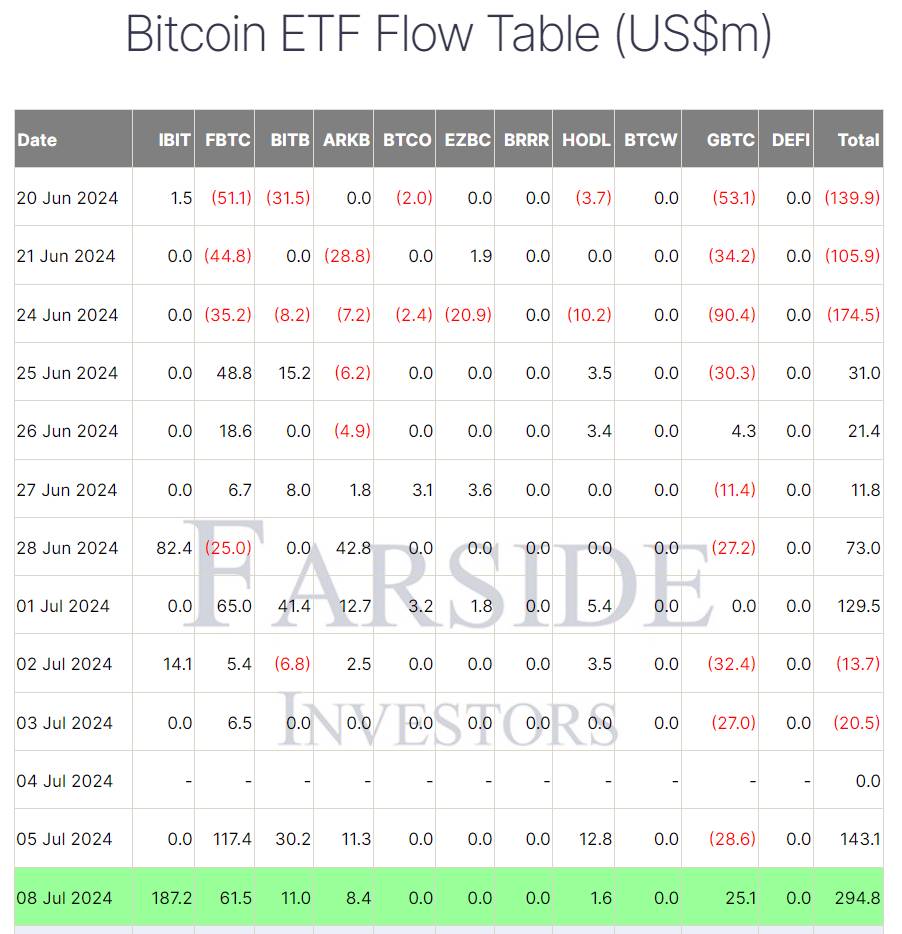

The spotlight is on the Bitcoin spot ETF market in the U.S., which recorded an “all green” trading day, with inflows reaching a remarkable $294.8 million. Furthermore, this marks the highest inflow in a single trading day over the past month.

According to Sosovalue data, the most recent trading day saw inflows surpassing July 8, with over $488 million recorded on June 5.

Among the 11 ETFs, BlackRock’s IBIT led the pack with $187.2 million in inflows, followed by Fidelity’s FBTC with $61.5 million and BlackRock’s GBTC with $25.1 million. These three funds accounted for 92% of the day’s net capital inflows.

Additionally, the German government’s recent movement of $900 million in Bitcoin turned out to be less concerning than initially thought. Arkham reported that $200 million worth of BTC had been transferred back to the German government’s wallet from Kraken, Coinbase, and Bitstamp within the past 12 hours.

This indicates that even though the assets were sent to exchanges, they were ultimately not sold on the market. Consequently, this did not impact the price of Bitcoin.

Currently, BTC is trading around $57,500, significantly recovering from the July 8 low of $54,260.