As July approaches, Ethereum ETFs are getting closer to their official launch with a series of green lights from the U.S. SEC. This optimistic signal has propelled ETH prices into a major uptrend, rising from $3,600 to $3,900 in just three days. CoinMinutes believes that ETH could soon reach the $5,000 mark.

ETH Investor Excitement Surrounds Market

On May 24th, the U.S. Securities and Exchange Commission (SEC) approved proposals for Ethereum spot ETFs by Grayscale and Bitwise to be listed on the NYSE, iShares (BlackRock) on the Nasdaq, and VanEck, ARK/21Shares, Invesco, Fidelity, and Franklin Templeton on the Cboe BZX Exchange. Note that ETF issuers still need to file their S-1 forms with the SEC to determine the official trading start dates. However, ETH has already surged from $3,100 to around $3,600–$3,800, marking a rapid 20% increase and reflecting strong investor excitement.

$ETH testing the 15m line pic.twitter.com/Ab6vt7miPm

— Don’t follow Shardi B if you hate Crypto (@ShardiB2) June 27, 2024

Despite the need for ETF issuers to submit S-1 forms and possibly make adjustments as required by the SEC, SEC Chairman Gary Gensler recently confirmed in an interview that everything is progressing smoothly. Moreover, a report from an anonymous source revealed that the SEC might approve these filings as early as next week, allowing Ethereum spot ETFs to begin trading before the Fourth of July holiday.

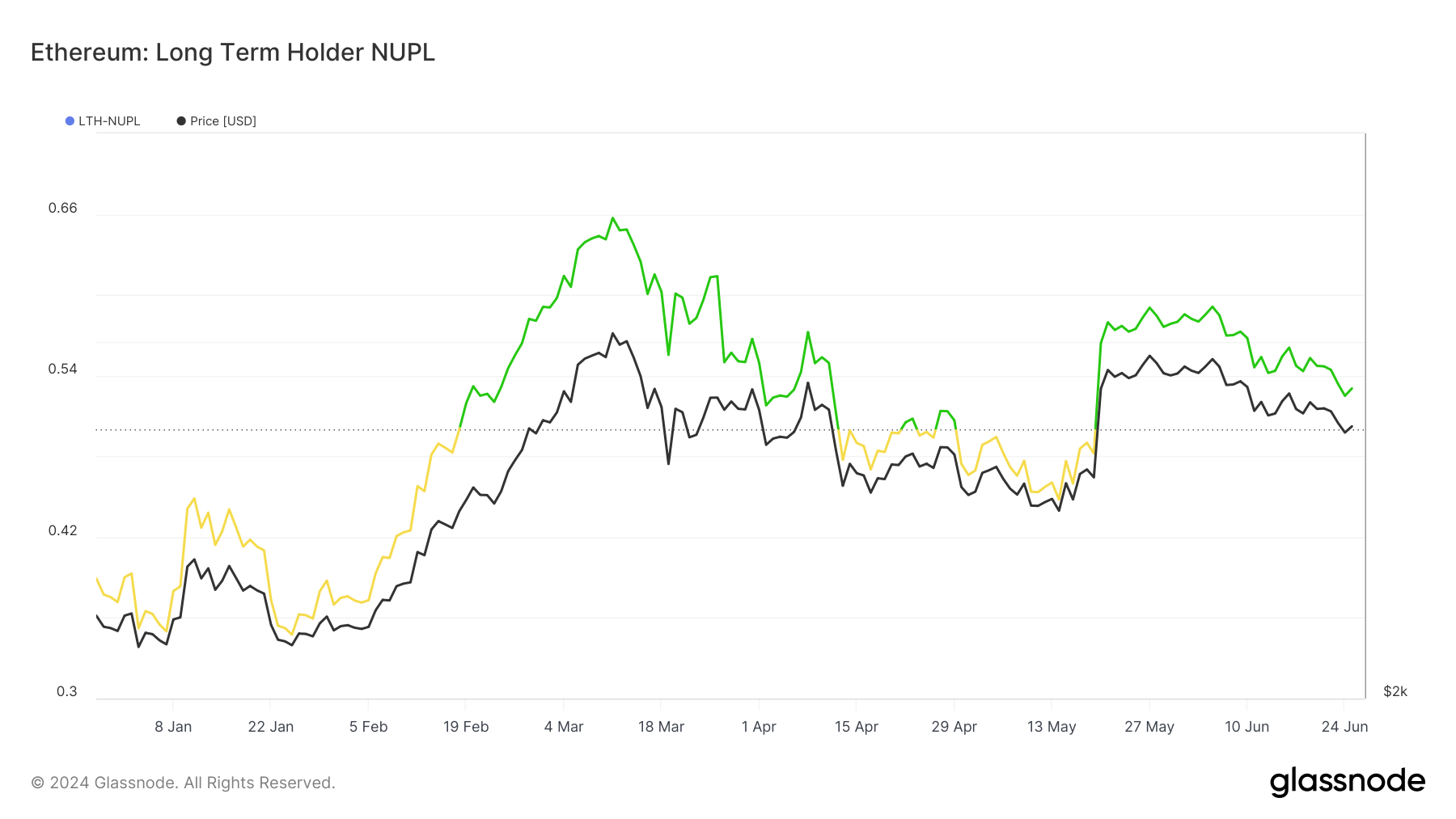

CoinMinutes has been monitoring the behavior of ETH holders across platforms like X, Telegram, and Discord. Our findings indicate that ETH investors are displaying extremely strong confidence in the cryptocurrency. Let’s take a look at the Long Term Holder-Net Unrealized Profit/Loss (LTH-NUPL) analysis provided by Glassnode. This metric measures the behavior of those holding cryptocurrency for over 155 days. As shown in the chart below, different colors represent different sentiments.

- Red: Caution

- Orange: Fear

- Yellow: Optimism

- Green: Greed

Ethereum’s LTH-NUPL is fully within the green bands, indicating investor confidence and optimism about a potential price increase.

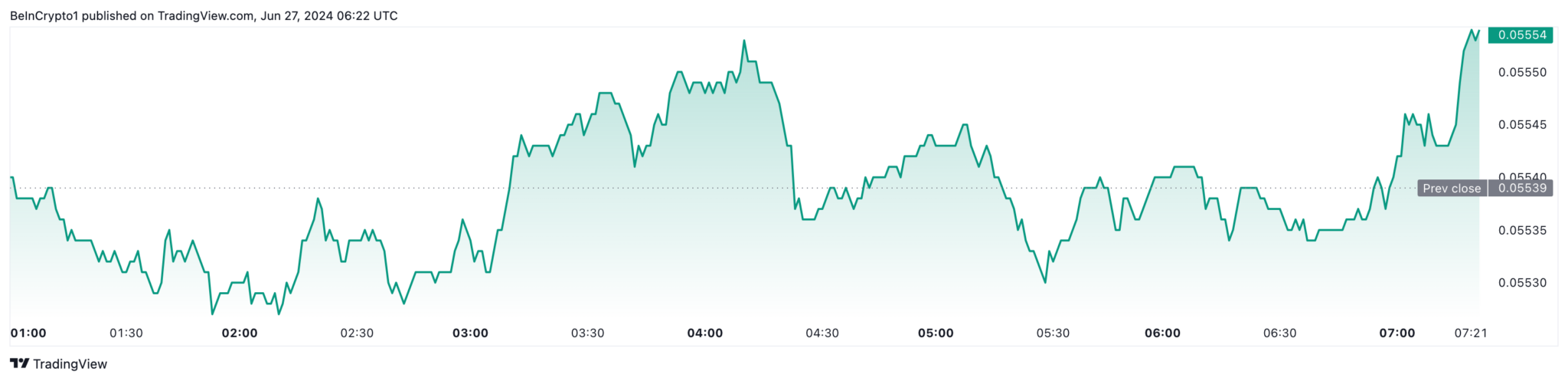

In addition to gauging investor sentiment, CoinMinutes also considers another indicator that can affect ETH’s price: the ETH/BTC ratio. This ratio indicates whether Bitcoin is outperforming Ethereum or vice versa. Specifically, if the ETH/BTC ratio is high, it means ETH is performing better than Bitcoin.

At the time of writing, this ratio stands at 0.055—up 2.33% over the past 7 days. This means that today, one ETH can buy 0.055 BTC.

If this ratio continues to rise, Bitcoin’s market dominance will decrease. This means Ethereum could break out, with its price potentially rising much higher. Looking at Bitcoin’s performance, its price increased by 56.95% in less than two months after approval. If ETH mirrors a similar move, its value could reach $5,308 by the end of Q3 this year.

Can ETF Ethereum Poise To Ignite The Next Bull Run Crypto?

The Ethereum ETFs are set to begin trading in early July, potentially boosting ETH demand and acting as a catalyst for the altcoin market. However, the main driver for ETH reaching $5,000 by year-end depends on macroeconomic factors.

The outlook for the cryptocurrency market heavily relies on the Federal Reserve’s interest rate policy. If the Fed signals two rate cuts in line with market expectations, cryptocurrencies could benefit from lower USD yields and reduced market costs. The upcoming PCE data, set to be released on Friday, will be crucial in assessing inflation.

If the PCE data is favorable, meeting or falling below expectations, it could indicate stable inflation, prompting the Fed to adopt a more accommodative approach to interest rates. Additionally, tomorrow’s data on U.S. unemployment and GDP will provide further insight into the economic outlook. At the beginning of July, cryptocurrencies face key support levels following the declines in June. Short-term market volatility is likely to increase as upcoming data releases and Fed decisions shape investor sentiment.