Despite having the largest market capitalization of any cryptocurrency, Bitcoin’s price is highly volatile. This offers profit opportunities but also carries risks of loss. Many people are now considering whether Bitcoin is a good investment after the 2024 Bitcoin halving event. Let’s answer that question in this article.

Key Takeaways

|

Is Bitcoin a Good Investment?

Evaluating Bitcoin as an investment option also depends on many factors such as market conditions, future expectations, and the stability of the currency. To determine whether Bitcoin is a good investment, users need to consider a few things:

- Market conditions: The volatility of Bitcoin prices may reflect instability in the global financial market and the overall economic situation.

- Future expectations: Users need to consider potential factors influencing the value of Bitcoin in the future, including the development of blockchain technology, regulatory policies of countries, and market acceptance.

- Risk tolerance: Due to Bitcoin’s high volatility, users need to assess their risk tolerance and determine whether they are willing to accept potential losses or not.

Factors Supporting Bitcoin as a Good Investment

Bitcoin is becoming a preferred investment asset for many people today. Why is that so? Let’s find out through the following reasons:

Scarcity and limited supply

Cryptocurrency value operates on the basic principles of supply and demand, akin to any desired commodity. When demand outpaces supply, prices rise.

The supply of Bitcoin is limited to 21 million units, a fixed and unchanging number over the years. The actual circulation might be below 21 million due to BTC being lost or not yet mined. This scarcity is what grants Bitcoin its potential for greater future price increases compared to other assets.

More facts about Bitcoin: coinminutes.com/learn/how-many-bitcoins-are-there

Hedge against Inflation

Scarcity is highly valued by humans as economists believe it can mitigate market behaviors such as inflation.

With its fixed supply and decentralized nature, not controlled by any unit, BTC serves as an effective tool against inflation and economic instability. This is why Bitcoin has earned the moniker “digital gold,” drawing comparisons with the actual precious metal. On the contrary, Fiat money can be manipulated by central banks through printing and devaluation.

Divisibility

Bitcoin offers far greater divisibility compared to fiat currencies. Each bitcoin can be divided into up to eight decimal places, with these smaller units termed satoshis. It means satoshis are worth fractions of a penny. This flexibility surpasses that of traditional currencies, enabling microtransactions—extremely small transactions.

During Bitcoin’s early days, its affordability and minimal transaction fees facilitated high-frequency, low-value transactions. Consequently, numerous online gambling platforms swiftly embraced Bitcoin as a payment method.

Growing Adoption

Primarily, they offer a decentralized alternative to conventional financial systems, fostering heightened transparency and transactional efficiency. Moreover, cryptocurrencies hold the promise of enhancing financial inclusion by extending banking services to the unbanked population.

The increasing acceptance of Bitcoin is evident through signs such as the number of stores accepting Bitcoin has risen from 1,000 to nearly 15,000 over the past decade, and the number of Bitcoin ATMs has also increased from 500 to over 10,000, marking the strong development of this currency.

This widespread adoption is underscored by prominent entities like Tesla and PayPal seamlessly incorporating cryptocurrency into their operations.

Given such extensive adoption and backing from diverse sectors, the appeal of cryptocurrencies as a promising investment opportunity in today’s dynamic financial landscape becomes increasingly evident.

Portability

Because Bitcoin is a type of digital currency, it is highly mobile and therefore extremely easy to transact with, meaning it can be stored and transferred electronically.

It can be stored on any personal device or flash drive and can be sent or received digitally almost instantly without incurring excessively high fees or unnecessary intermediaries. This makes it more portable than traditional assets such as gold or real estate.

Bitcoin can be used across borders, allowing any internet-connected consumer to participate in the global economy and access financial services.

Uniformity

Bitcoins are immune to counterfeiting. Essentially, Bitcoin’s purely digital nature, being code-based and devoid of physical form renders counterfeiting impossible. Even physical versions of Bitcoin, created due to the demand of certain groups must undergo a transparent verification process to ensure high credibility.

Moreover, Bitcoin’s resistance to counterfeiting arises from its utilization of blockchain technology and diverse consensus mechanisms, forming a robust protocol dubbed “consensus.” This ensures uniformity among units of the asset, reinforcing its integrity.

Risks of Investing in Bitcoin

Price Volatility and Market Fluctuations

Bitcoin, famous for its volatility, experiences sharp price swings influenced by market dynamics and investor sentiment. The cryptocurrency market’s unpredictable nature means values can surge one day and plummet the next.

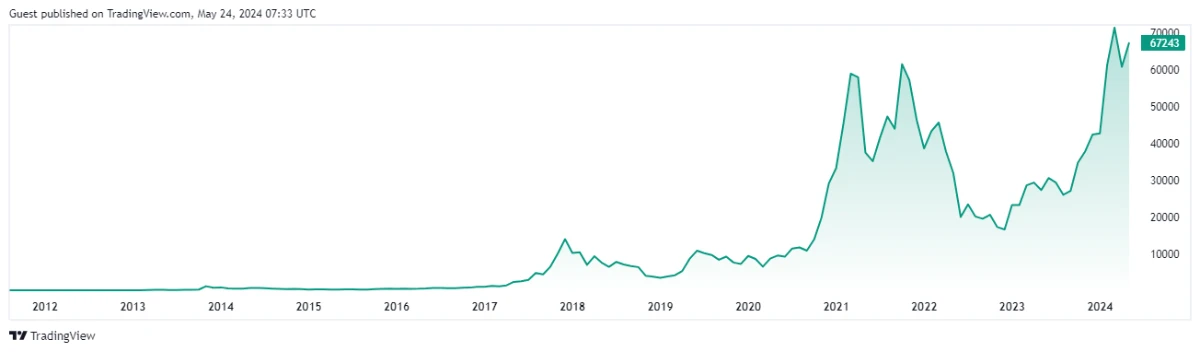

In the past, Bitcoin has experienced significant price surges, followed by cryptocurrency winters. For instance, after reaching a peak near $19,000 in late 2017, Bitcoin’s price fell below $4,000 in 2018. Similarly, after reaching a peak near $65,000 in April 2021, the price dropped significantly to below $30,000 in July of the same year.

For those unaccustomed to navigating market risks, this environment can prove daunting. Much like traditional stock markets, Bitcoin prices experience fluctuations, however, the digital realm often amplifies these fluctuations, rendering the landscape even more unpredictable.

Regulatory Uncertainty and LegalRisks

Despite its growing popularity, Bitcoin’s status as an official currency remains unrecognized by many countries, leading to ongoing deliberations among governments and regulatory bodies worldwide.

While nations like El Salvador and the Central African Republic have embraced Bitcoin by integrating it into their official currency systems, others, such as India have taken a firm stance by outlawing cryptocurrencies—notably, China, which vehemently opposes Bitcoin’s introduction into the country.

As for countries that have approved Bitcoin, they also face countless barriers such as the US government currently grapples with the complex challenge of establishing effective regulations regarding cryptocurrencies.

Technological Risks and Security Vulnerabilities

In blockchain systems, manipulating the transaction ledger usually necessitates control over a majority of validation nodes. Moreover, cryptocurrency exchanges, vulnerable to cyber threats, are susceptible to security breaches. The Mt. Gox hack (2014) and Bitfinex hack (2016), involving the loss of 850,000 and 120,000 Bitcoins respectively, highlight this vulnerability leading to significant declines in market confidence and Bitcoin’s value.

Forgetting the password to your digital wallet poses a significant risk. Worse yet, losing the smartphone or hardware wallet containing your Bitcoin and Ethereum holdings can be catastrophic.

Recovering lost digital funds is often challenging, if not impossible. Unlike a human banker who may assist in such situations, computers cannot proactively aid in the retrieval of lost fortunes.

The Bottom Line

In conclusion, the question ‘Is Bitcoin a good investment?’ remains a subject of debate. While the potential for high returns is enticing, the volatility and regulatory uncertainty can pose significant risks. It’s crucial to conduct thorough research and consult with financial experts before making any investment decisions regarding Bitcoin.