On May 14, 2024, the decentralized lending protocol Liquity announced Liquity V2 on their official Twitter (X) account. Liquity V2 is introduced as a more efficient lending protocol than its predecessor.

It’s time for the next evolution of CDPs.@LiquityProtocol v2 Whitepaper is out (link at the end of the 🧵)

Keeping the decentralization ethos & adding:

• User-set interest rates

• LSTs as collateral

• Better capital efficiency

• Protocol Incentivized Liquidity (PIL)— Liquity (@LiquityProtocol) May 14, 2024

In V2, a new stablecoin called BOLD is launched. It will be Ethereum-based and will have minimal centralized collateral risk.

BOLD will operate alongside LUSD (Liquity’s stablecoin in V1) and will offer the following improvements:

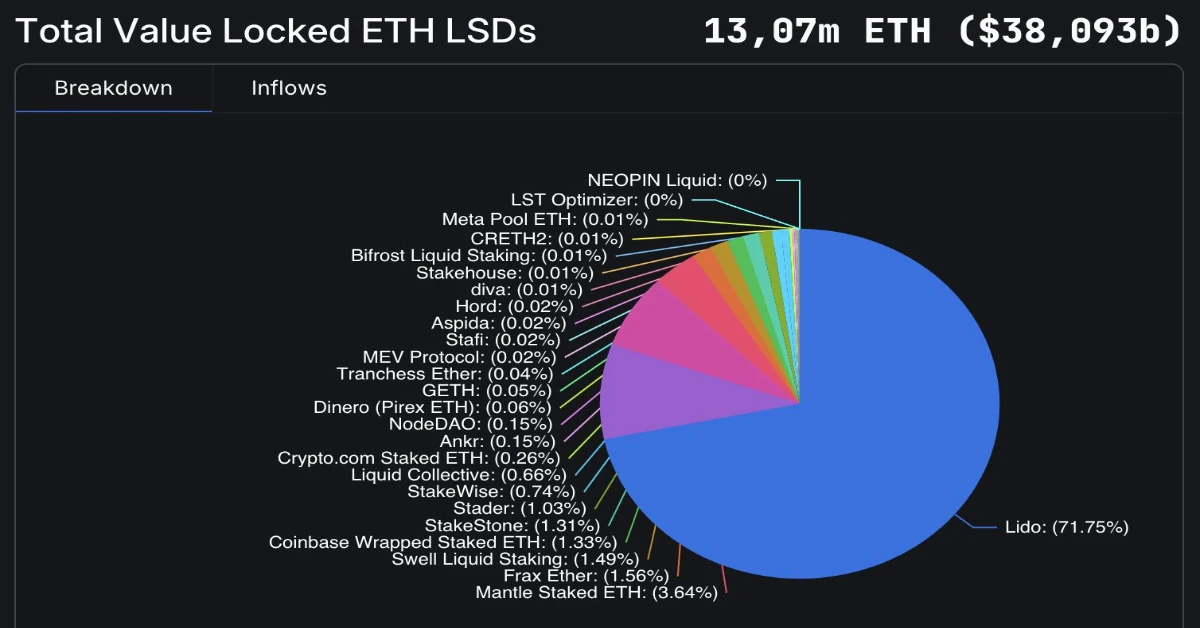

Support for various collateral types (ETH & LST): In this V2 version, users can use ETH and its variants as collateral.

More attractive short-term loans: Users will pay interest over the time they borrow instead of an upfront fee like in V1.

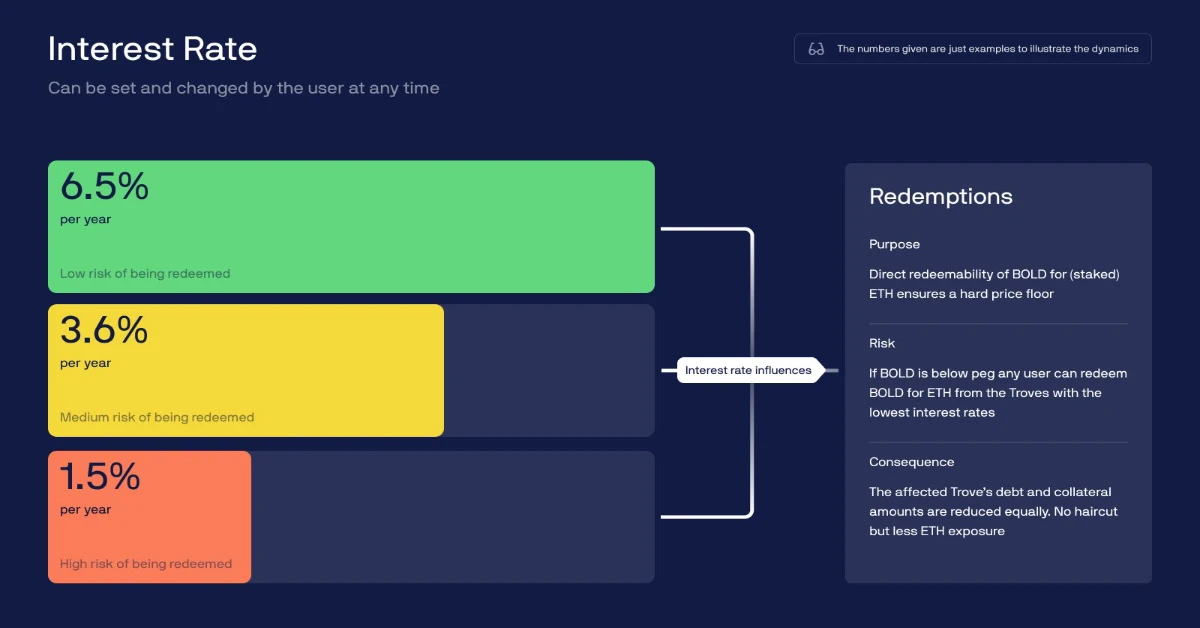

User-selected interest rates: This is the most unique upgrade of V2 compared to the previous version. It allows users to choose interest rates ranging from 0.5% to 1000%.

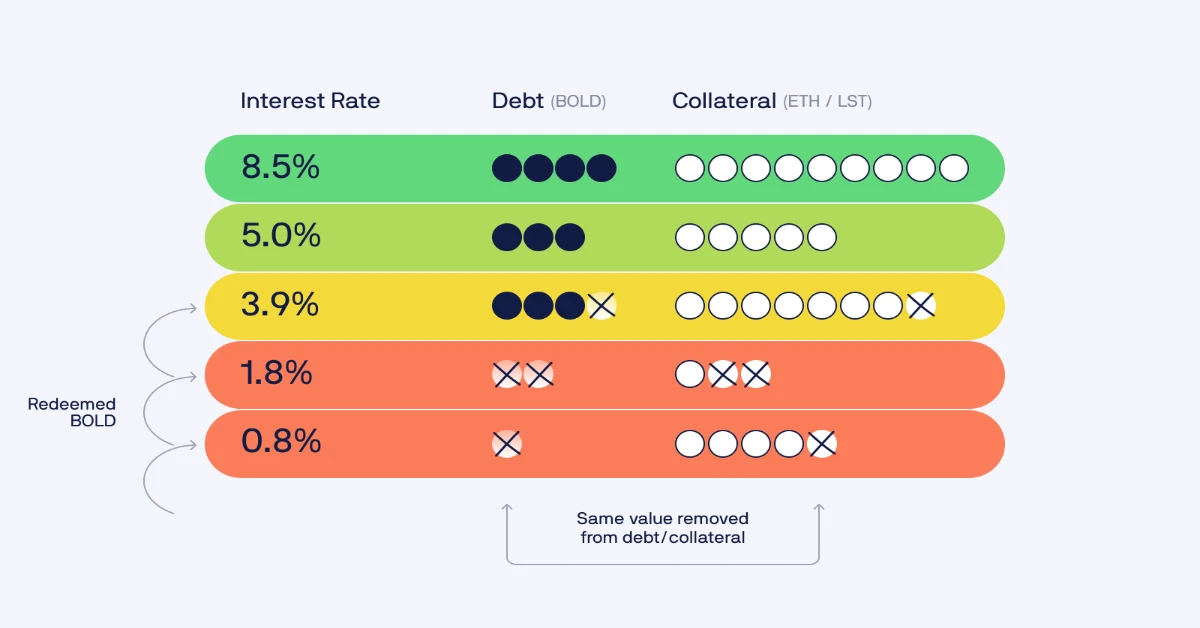

Improved redemption mechanism: Collateral assets for redemptions are taken from borrowers currently paying the lowest interest rate, in exchange for their debt being reduced accordingly. Borrowers affected by redemption will lose access to their collateral even if they do not suffer financial loss at that time. In other words, the higher your interest rate, the lower your redemption risk.

Real yield: Liquity V2 comes with sustainable real yield in the form of continuous interest payments (in BOLD) from borrowers to depositors in the Stability Pool.

Peg upgraded: This V2 version will always ensure the price stability of BOLD. When too much BOLD is created, the interest rate is increased, and conversely, when the supply is low, the interest rate will decrease.

These improvements aim to address issues from V1 where the rising market interest rates for stablecoins put high selling pressure on LUSD and led to massive conversion volumes into ETH. Liquity V1 borrowers increased their collateral ratios significantly to avoid being redeemed, which reduced Liquity’s effective lending capacity.