Bitcoin has become very valuable since it was first mentioned in 2008. With Bitcoin price reaching over $73,000 in 2024 and likely to increase in the future.

This sparked questions about Bitcoin from investors looking for information about this digital asset. How many Bitcoins are there? And how many are left for people to mine?

In this article, CoinMinutes will answer the above questions and questions related to the number of Bitcoins.

Key Takeaways

|

How Many Bitcoins Are There?

Bitcoin has a total supply cap of 21 million coins, which is an immutable limit set by the protocol. This is different from regular money, which can be printed endlessly, causing its value to drop. By limiting the total number of Bitcoins to 21 million, scarcity is created, akin to precious metals like gold.

According to CoinMarketCap data, there are 19,697,650 Bitcoins in circulation right now, with new coins entering the supply roughly every 10 minutes through the mining process. Moreover, Bitcoin is expected to reach its maximum supply by 2140 due to the mechanics of the ‘halving’ system.

Factors Affecting Bitcoin Supply in Circulation

Mining Difficulty

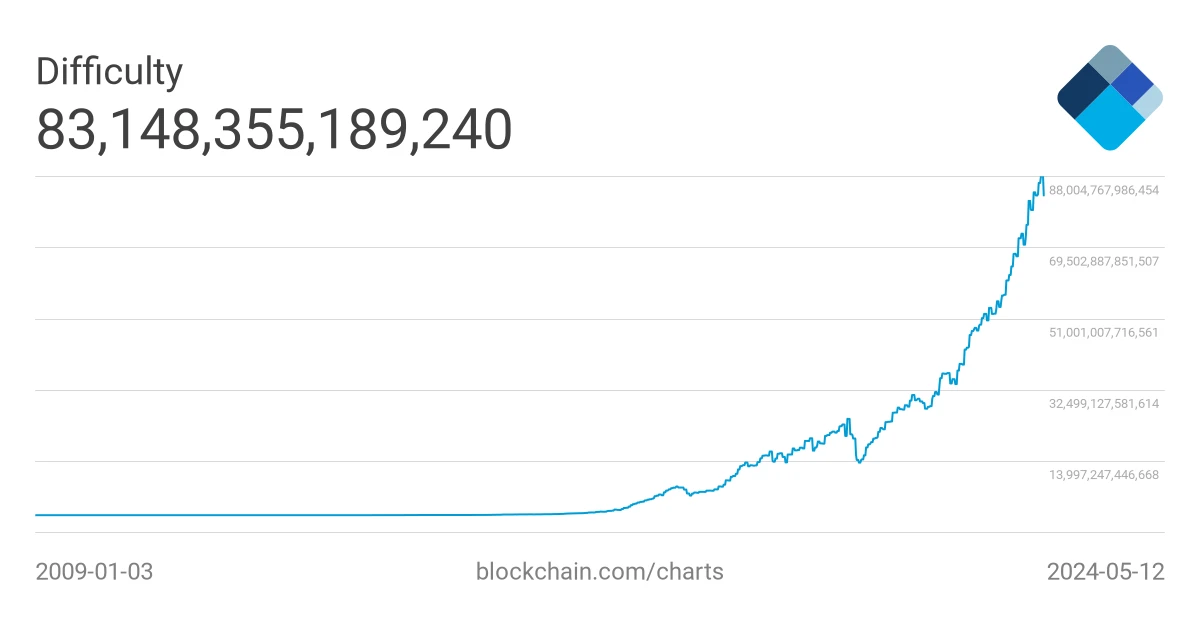

In proof-of-work (PoW) blockchains like Bitcoin, mining difficulty refers to the level of challenge and time required to solve complex mathematical puzzles in cryptocurrency mining. The difficulty of mining Bitcoin is a self-adjusting mechanism aimed at maintaining the time to generate each block around 10 minutes.

At this point, the Bitcoin network will automatically adjust the difficulty of the Proof-of-Work algorithm corresponding to the available mining capacity (hash rate) of miners at that time. As the hash rate and difficulty increase, it indicates that more miners are joining the Bitcoin mining process, resulting in a higher level of competition. Additionally, the difficulty of mining Bitcoin will be adjusted after every 2,016 blocks, approximately every 2 weeks.

Halving Events

The Bitcoin halving effect refers to the reduction in rewards for Bitcoin miners that occurs approximately every four years. During this event, the reward for mining new blocks is halved, leading to a decrease in the rate at which new Bitcoins are created and introduced into circulation.

The halving effect directly impacts the supply of Bitcoin in circulation by reducing the rate at which new Bitcoins are generated. With fewer Bitcoins being produced, the overall supply in circulation increases at a slower pace, thereby contributing to Bitcoin’s scarcity over time. This scarcity is a fundamental aspect of Bitcoin’s design and is intended to enhance its value proposition as a decentralized digital currency.

Lost Bitcoins

Lost Bitcoins refer to coins that are no longer accessible or recoverable due to various reasons, such as forgotten passwords, lost private keys, or damaged storage devices. These Bitcoins remain inactive within the Bitcoin network, unable to be spent, sold, or traded.

Bitcoin can be lost due to various reasons:

- Forgotten or Lost Private Keys: The most common cause of Bitcoin loss is users forgetting their private keys or seed phrases, which are essential for accessing their Bitcoin wallets.

- Hardware Failure or Loss: Bitcoins stored in hardware wallets may be lost if the devices are damaged, lost, or stolen, and users have not backed up their seed phrases.

- Sending to Incorrect Addresses: Bitcoin transactions are irreversible, so if a user sends BTC to the wrong address, they are unlikely to recover it.

- Unused Wallets: Early Bitcoin adopters may have purchased Bitcoins when they were worth very little and then forgotten about them as their value increased over time.

When a specific amount of Bitcoin stays the same for a while, the market perceives this as if these Bitcoins have been taken out of circulation. Each lost Bitcoin makes the remaining Bitcoins slightly more valuable, as demand for the limited supply increases.

Forks and Splits in the Blockchain

In the context of blockchain ledgers, Bitcoin forks and splits refer to instances where Bitcoin blockchain diverges into two separate paths due to changes in its protocol or disagreements within the community.

Specifically, a fork refers to the process of implementing a new upgrade to a blockchain network. This happens as developers update the protocol to improve the software or fix issues.

These forks can be categorized into soft forks and hard forks, each with its implications for the network.

- Hard Fork: A Hard Fork is a non-backward compatible change to a blockchain protocol. This means that nodes that have not updated to the new version will not be able to process transactions or add new blocks to the blockchain.

- Soft Fork: A Soft Fork is a backward-compatible upgrade in blockchain protocol. Nodes that have not been updated can still process transactions and add new blocks to the blockchain, as long as they do not violate the rules of the new protocol.

Bitcoin can fork into many different chains such as Bitcoin Gold, Bitcoin Cash, BitcoinABC, BitcoinSV, etc. The impact of forks and splits on the Bitcoin supply in circulation depends on the type of fork and the resulting actions taken by users and developers.

While soft forks generally do not directly affect the supply, hard forks can lead to an increase in the total supply of cryptocurrencies, including Bitcoin, due to the creation of new coins. However, the significance of this increase depends on various factors such as market demand, acceptance of the new cryptocurrency, and community consensus.

How Many Bitcoins Have Been Mined Already?

The data from CoinMarketCap shows that approximately 19.7 million Bitcoins are currently in circulation, with this figure fluctuating every 10 minutes as new blocks are mined.

How Many Bitcoins Are Left to Be Mined?

Approximately 1.3 million Bitcoins are remaining to be mined. Nonetheless, you can always purchase Bitcoins from existing users on exchanges.

How Many Bitcoins Are Mined Everyday?

On average, 144 blocks are mined each day with a reward of 3.125 BTC, so there will be 450 Bitcoin mined each day.

How Many Bitcoins Are Lost?

Approximately 3-4 million Bitcoins are estimated to be irretrievably lost, according to Unchained Capital. Despite being labeled as “lost,” all Bitcoins remain visible on the blockchain, inaccessible without their corresponding keys.

How Many Bitcoins Have Been Stolen?

The exact number of stolen Bitcoins is uncertain. The Mt. Gox hack, the largest theft, took 850,000 BTC, while Bitfinex lost 120,000 BTC in 2016, totaling around 970,000 BTC. However, stolen BTC may still be in circulation, not necessarily held by the initial thieves.

How Many Bitcoins Does Satoshi Have?

Estimates suggest that Satoshi Nakamoto may possess approximately 1,000,000 Bitcoins (BTC). This number is heavily debated, though, as some claim he has around 300,000 BTC.

Who Has the Most Bitcoins?

As discussed above, it’s likely that Satoshi, the creator of Bitcoin, has the most Bitcoins of anyone.

When Will the Last Bitcoin Be Mined?

The last Bitcoin halving is projected around 2140, but predicting the exact date is difficult due to the changing landscape.

What Happens When All 21 Million Bitcoins Are Mined?

Currently, miners primarily earn income through the block reward. However, once all 21 million Bitcoins are mined, there will be no block reward for miners. Instead, miners will rely on transaction fees attached to Bitcoin transactions.

How Many Bitcoins Will Be Mined Before The Next Halving?

Approximately 35,375 BTC are remaining until the next block reward halves.

The Bottom Line

Understanding the factors influencing Bitcoin’s supply in circulation is crucial for grasping its value and market dynamics. With a capped supply of 21 million coins and approximately 19.7 million Bitcoins currently in circulation, Bitcoin’s scarcity is a fundamental aspect contributing to its value proposition.

Factors such as mining difficulty, halving events, lost Bitcoins, and blockchain forks all play a role in shaping the availability and perceived value of Bitcoin in the market. As Bitcoin continues to evolve, these factors will remain essential considerations for investors, miners, and enthusiasts alike.