Since its launch 15 years ago, Bitcoin’s status has changed significantly. Its value has fluctuated wildly, from nearly nothing to an all-time high of $73,000 per BTC. Over time, Bitcoin has gained increasing acceptance among individuals and governments.

Key Takeaways

|

When Did Bitcoin Start?

Bitcoin is the pioneer cryptocurrency that emerged as the first and most widely recognized digital asset.

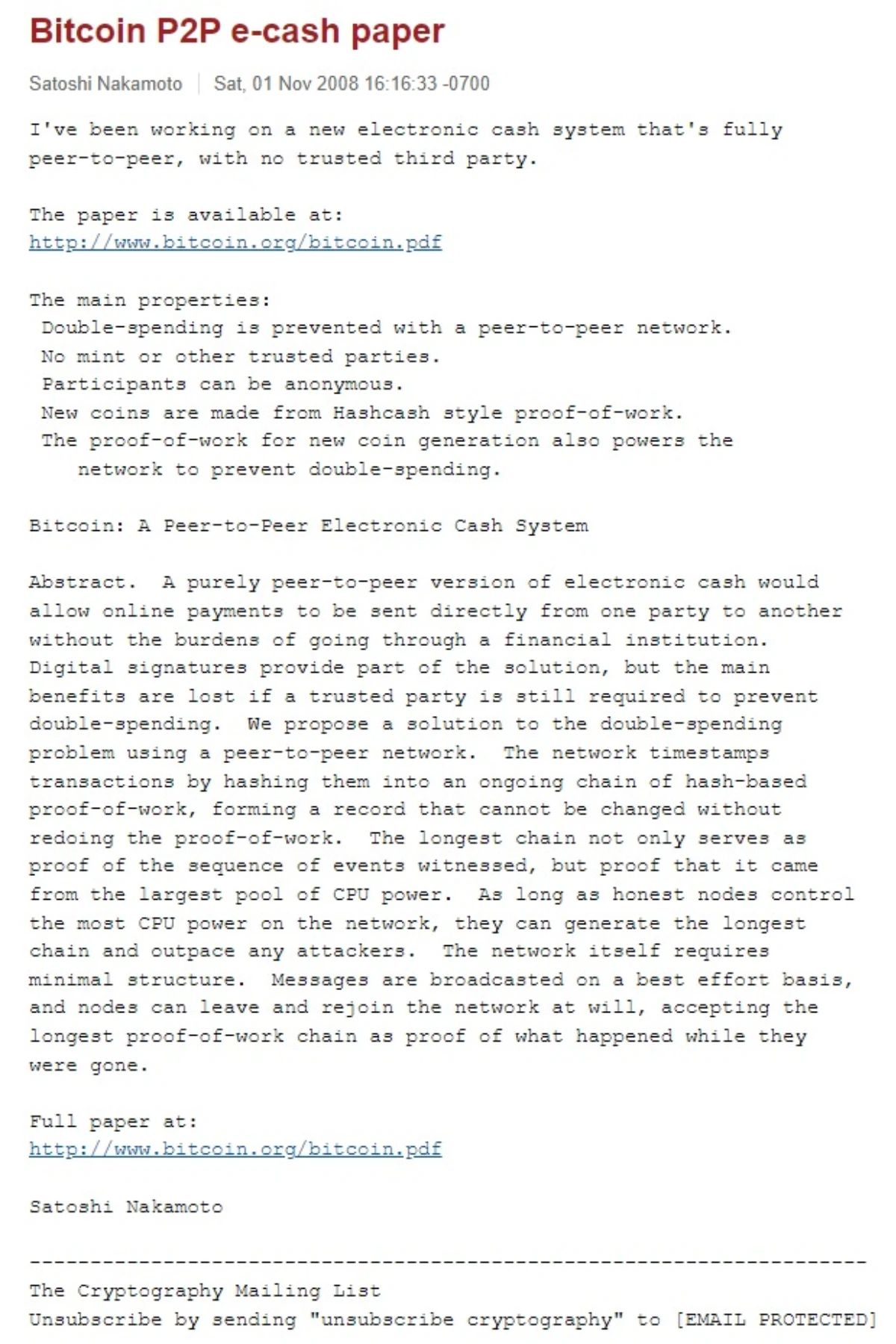

It was introduced in 2008 by an individual or group of programmers under the alias Satoshi Nakamoto through the Bitcoin White Paper.

At that time, the world economy was in a serious crisis. People were losing faith in financial institutions as well as government economic policies. Bitcoin appeared as a solution that did not depend on any individual or organization.

History of Bitcoin

In just 15 years, Bitcoin has transformed from an unknown cryptocurrency into a household name among investors and the general public.

2008: Bitcoin’s journey began on October 31, 2008, when a user named Satoshi Nakamoto shared the Bitcoin Whitepaper on a cryptography forum.

The Whitepaper, titled “Bitcoin: A Peer-to-Peer Electronic Cash System,” introduced a decentralized transaction network, bypassing the need for intermediaries like banks or payment apps.

Satoshi implemented Stuart Haber and W. Scott Stornetta’s Chain of Blocks technology, renaming it the Distributed Blockchain, to power the Bitcoin network. Additionally, Satoshi enhanced Bitcoin’s security and data storage capacity by modifying the Merkle Tree structure.

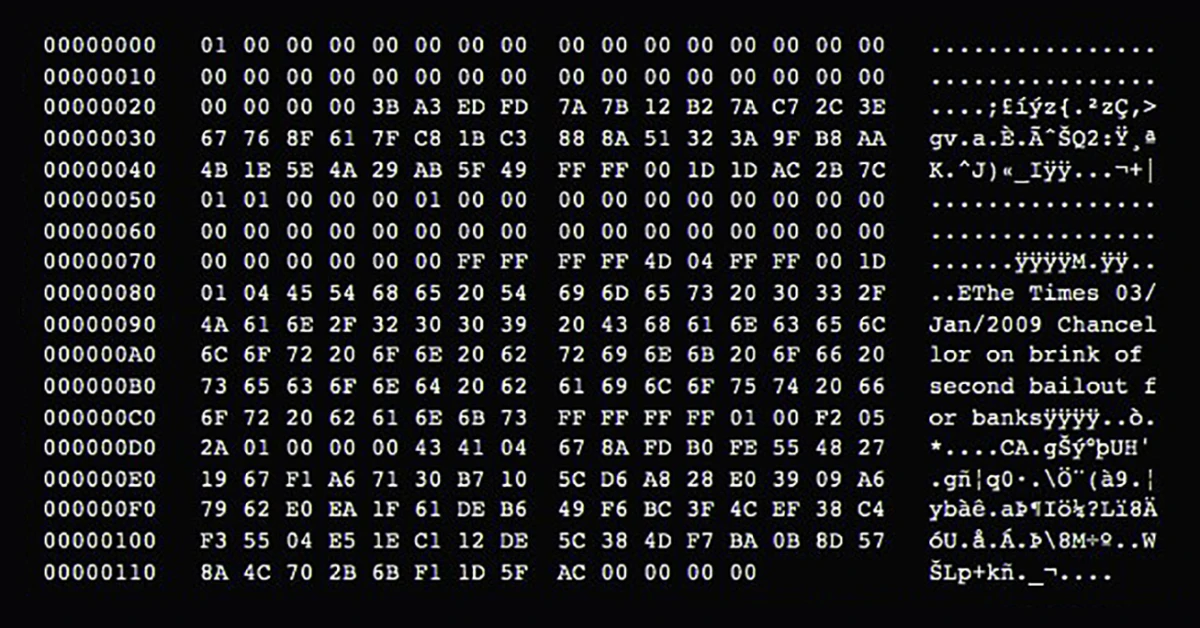

2009: While the Bitcoin Whitepaper emerged in October 2008, the official launch of the Bitcoin network occurred in early 2009.

On January 3, 2009, Satoshi Nakamoto “mined” the Genesis Block, marking the inception of the Bitcoin blockchain.

Three days later, Satoshi executed the first-ever Bitcoin transaction, transferring 10 BTC to Hal Finney, the inaugural Bitcoin user. This historic transaction was recorded in block number 170.

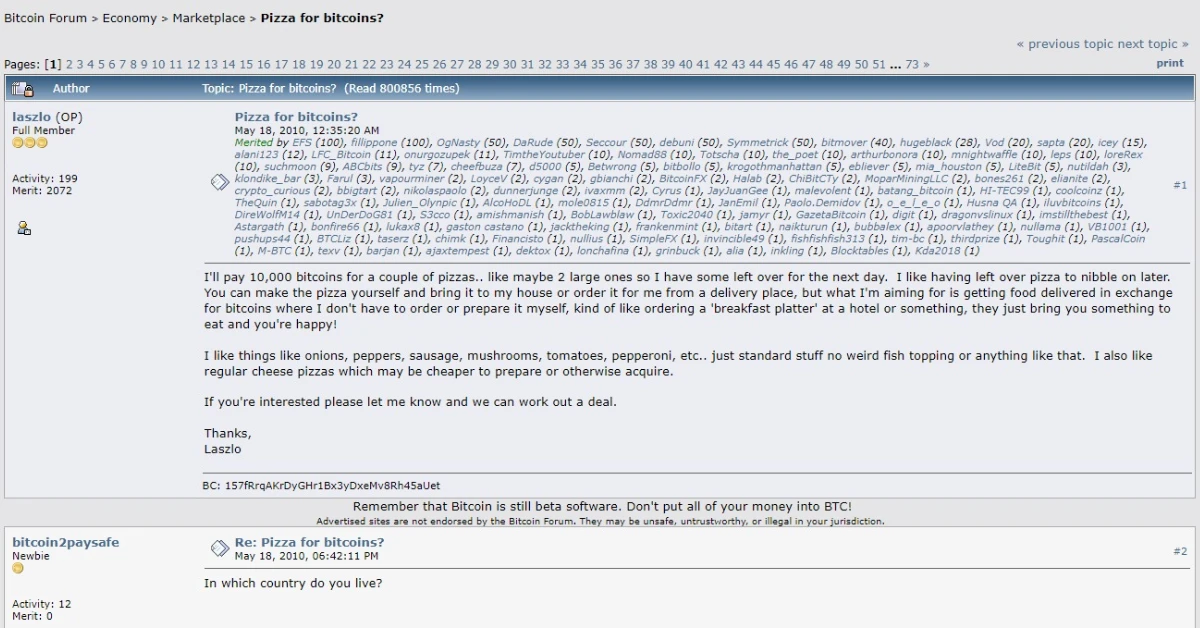

2010: On May 22, early Bitcoin miner Laszlo Hanyecz, known as “Laszlo” on the forum bitcointalk.org, made history by exchanging 10,000 Bitcoins (worth $41 at the time) for two Papa John’s pizzas from Jeremy Sturdivant.

This exchange became a memorable moment in the development of Bitcoin. It has become an annual event on May 22nd known to everyone as Bitcoin Pizza Day.

2011: In February, Bitcoin’s value soared to $1, marking a significant milestone in its ascent. By December of the same year, it surged to over $13, signifying its rapid growth.

During this period, blockchain.info was launched to facilitate easier tracking of BTC. Blockchain.info (now Blockchain.com) played a crucial role by developing a cryptocurrency wallet, enabling users to store their digital assets securely.

That same year, a 12-year-old boy invested $1,000 given to him by his grandmother in Bitcoin. This amount is equivalent to 100 BTC (about $10 per Bitcoin). He quickly rose to fame as one of the first cryptocurrency millionaires.

2012: On November 28, the first Bitcoin Halving event took place. This event was programmed by Satoshi Nakamoto to ensure scarcity and non-inflation for Bitcoin by halving the BTC reward for miners every 210,000 blocks mined (approximately 4 years).

After the first halving event, the block reward was reduced from 50 BTC to 25 BTC.

2013: Bitcoin reached $1,000 for the first time in November 2013, but did not hold its price for long. Bitcoin closed in 2013 at $700, according to data from CoinDesk.

In May, the U.S. Department of Justice shut down Liberty Reserve, a virtual currency site, for laundering approximately $6 billion from illicit activities, including credit card fraud. Founder Arthur Budovsky, 42, pleaded guilty to laundering $250 million in illegal proceeds.

July 1, 2013, marked the first attempt at a Bitcoin Exchange-Traded Fund (ETF) when the Winklevoss twins filed a proposal with securities regulators. Although considered a long shot at the time, the move aimed to bolster Bitcoin’s legitimacy as a legitimate currency.

December 5, 2013, saw China announcing a ban on third-party payment institutions from utilizing Bitcoin, mandating the cessation of all deposit-taking, trading, and other currency-related services.[1] This marked one of the earliest instances of a country speaking out against this cryptocurrency.

2014: The Internal Revenue Service (IRS) declared that gains or losses in cryptocurrency must be reported and treated as property. This ruling meant that income from cryptocurrency sales would be subject to taxation as capital gains, akin to profits from stock transactions.

MT. Gox, a major exchange handling most Bitcoin trades, went bankrupt because hackers stole a huge amount of Bitcoin.[2] This event worried many investors and showed that the Bitcoin industry lacked proper rules and oversight. After this, the price of Bitcoin stayed around $200 to $600 for three years.

2015: Bitcoin experienced a gradual upward trajectory, culminating in a year-end value of approximately $430.

2016: On July 9, 2016, Bitcoin experienced its second halving event, reducing the reward per block from 25 BTC to 12.5 BTC. After the halving event, the price of Bitcoin initially dropped, but it gradually increased over time and eventually reached $972 by the end of the year.

In October 2016, certain community members suggested the Segregated Witness (SegWit) solution to enhance scalability by optimizing the block size of BTC.

2017: In July 2017, the upgrade was halted due to community discord. Advocates for a Bitcoin with block sizes exceeding 1 MB instigated a hard fork, resulting in the birth of Bitcoin Cash (BCH).

Read more: What is Bitcoin fork?

During this period, two US exchanges, CME and CBOE, started letting people trade contracts for the future price of Bitcoin. Bitcoin’s price shot up from $2,000 in July 2017 to nearly $20,000 by the end of the year.

2018: Following that, the fervor surrounding the world’s largest cryptocurrency dwindled in 2018, with Bitcoin plunging and breaking through the $4,000/BTC threshold.

2019: The IRS provided additional guidance on cryptocurrency transactions, including purchases, sales, and trades, using Form 8949 for reporting capital gains and losses, then the market capitalization of Bitcoin reached over $229 billion.

During the same year, Bitcoin reached a peak of $12,862.48/BTC on July 10, 2019, but swiftly declined to a low of $7,233.41/BTC on December 18, 2019.

2020: Bitcoin experienced a dramatic surge, leaping from $7,350 to $30,000.

On May 11, 2020, Bitcoin underwent its third halving event, resulting in miners receiving 6.25 BTC per block, down from the previous reward of 12.5 BTC per block. Similar to the pattern observed in 2016, Bitcoin’s price initially dropped after the halving.

However, it rebounded from its 2020 low of $3,858, reaching $12,100 in late July 2020. On December 16th, 2020, Bitcoin shattered the $23,000 barrier, surpassing the historic $20,000 mark.

On August 11, 2020, MicroStrategy announced the acquisition of 21,454 BTC, valued at over $250 million. This marked the first instance of a publicly traded company investing in BTC.

2021: In the early months of 2021, initiating the market’s bull run, Tesla made headlines by investing $1.5 billion in Bitcoin on February 8.

Expanding its involvement, Tesla started accepting BTC as a payment method in the United States.[3] This development sent shockwaves across the globe with “Tesla, Elon Musk, Bitcoin” dominating headlines. Elon Musk emerged as a prominent figure in the crypto market.

El Salvador made history by becoming the first nation to adopt Bitcoin as legal tender.[4] By March 2024, the country’s investment in Bitcoin had resulted in significant profits, marking a major milestone for the Central American nation.

2022: By December 23, Bitcoin is trading below $17,000, signaling a 60% loss in value for 2022. This year signifies the start of the digital currency winter cycle triggered by the collapse of several prominent companies.

2023: On January 10, the approval of Bitcoin ETFs by the SEC marked a pivotal moment, signaling Bitcoin’s enduring presence and its readiness for widespread accessibility.[5] Bitcoin ETFs offer a key advantage by enabling investors to purchase Bitcoin through traditional brokerage accounts, eliminating the need for direct cryptocurrency purchases, which often demand technical expertise and a crypto wallet.

2024: On March 14, Bitcoin hit a new high of $73,750.07 per BTC. Then the 4th halving event took place on April 19th, the Bitcoin reward decreased to 3.125 BTC.

The Bottom Line

Bitcoin has had a remarkable journey, experiencing significant changes, ups and downs. It started as a mystery and has evolved into a well-known investment option. Along the way, it has faced various challenges, including hacking and government regulations, but it has also seen substantial increases in its value. Nevertheless, Bitcoin continues to be an intriguing part of the future of currency.

Related: Bitcoin price history