Daily money transfers have become simpler than ever with the use of QR code scanning. With just a few steps, you can make payments to your friends, and family, or shop at various stores. So, is transferring Bitcoin as easy and convenient as it sounds?

The answer is yes but with a few differences. Now, let’s explore how to send Bitcoin in minutes with CoinMinutes. By following these simple yet important steps, you can ensure the security and efficiency of your Bitcoin transactions.

Key Takeaways

|

How to Send Bitcoin?

Step 1: Obtain and input the Bitcoin address of the recipient

To send Bitcoin, you need the recipient’s Bitcoin wallet address. It’s crucial to ensure that you accurately copy down the address, as Bitcoin transactions are irreversible.

Step 2: Enter the Amount of Bitcoin to Transfer

Specify the exact amount of Bitcoin you want to send. Additionally, you should consider covering the network fee associated with the transaction.

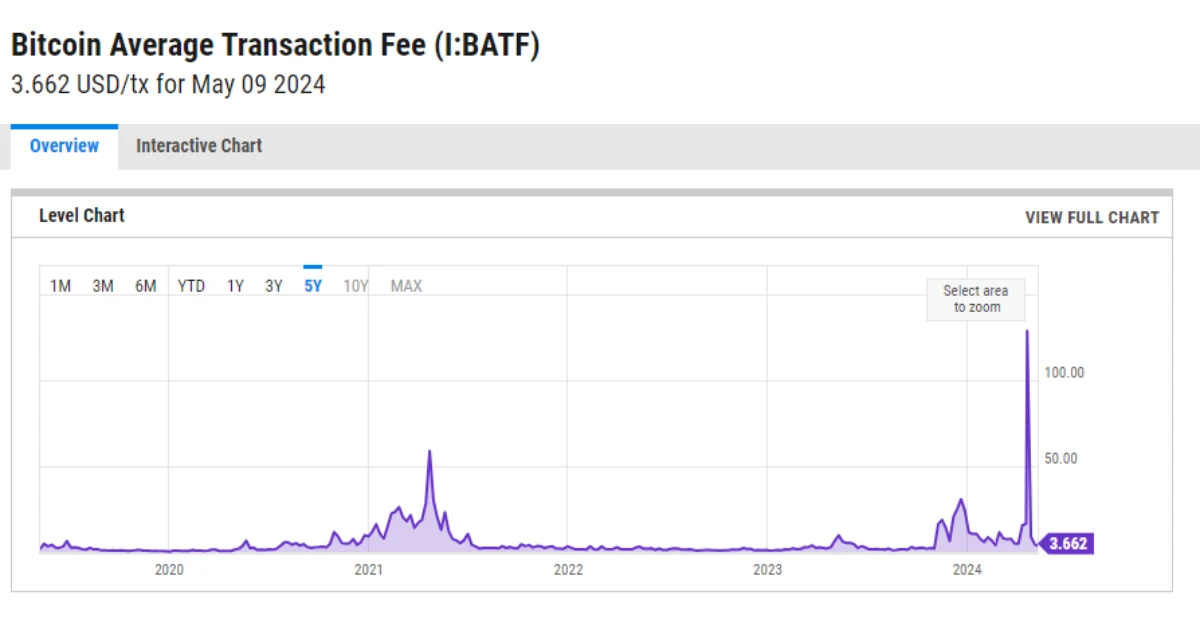

Bitcoin transaction fees depend on two factors:

- The size of the transaction: In the Bitcoin system, transaction fees depend on the size of the transaction, not the amount of Bitcoin transferred. The transaction size is determined by factors like inputs and outputs, measured in bytes. So, whether you transfer 1 BTC or 1000 BTC, if the transaction size remains the same, the fee will not change.

- User demand for block space: Users who desire faster confirmation of their transactions are willing to pay higher fees.

Step 3: Confirm and Send Your Bitcoin

Once you’ve confirmed the details of the transaction, your wallet uses your private key to sign it. This signature provides proof of your authorization to send the Bitcoin. The signed transaction is then submitted to the blockchain nodes for verification and execution.

It’s worth noting that the specific steps may differ slightly depending on the type of Bitcoin wallet you use.

How Does Sending Bitcoin Work?

In a Bitcoin user’s mind, sending a transaction is as simple as entering the amount and recipient’s address, followed by a click on the “Send” button. However, behind this seemingly effortless action lies a complex and fascinating technical process.

Bitcoin Address

Public Key

A public key is a shorter string of letters and numbers that is made public and shared with other users on the network. It is a cryptographic code linked to your private key, necessary for verifying and decoding transactions. This helps protect your ownership and management of digital money while facilitating convenient receipt of contributions or other transactions.

Private Key

A private key is an integral part of cryptocurrency, and its encrypted properties help to protect a user from theft and unauthorized access to their funds. The private key proves ownership or spends the funds associated with the user’s public key address. The private key can come in various forms, from a long 256-character binary code, a 64-digit hexadecimal code, a QR code, to a memorable phrase.

An important advice is to never share your private key with anyone.

How Blockchain Records Transactions

The blockchain records transactions through a decentralized ledger system. Blockchain distributes information across a network of computers instead of storing it on a single server.

Users create and sign transactions using their private keys, including information such as the recipient’s address, the amount transferred, and the fee. These transactions then propagate across the blockchain network.

Miners play a crucial role in verifying and organizing transactions into blocks, competing to solve a puzzle. The first successful miner adds their block to the blockchain. Different consensus mechanisms like Proof of Work (PoW) determine the next block miner.

Once added, blocks make transactions immutable and irreversible, updating the recipient’s balance. For full security, transactions may require multiple confirmations from subsequent blocks. This protects against attacks or network reorganizations.

Components of a Bitcoin Transaction

Input refers to a previous transaction’s output. The new transaction combines the values of all its inputs (i.e., the total amount of coins from the referenced previous outputs), deducts any transaction fee, and uses this total to fund the outputs of the new transaction.

- Unspent Transaction Outputs (UTXOs): Bitcoin doesn’t exist as a unified unit. Instead, it is stored as Unspent Transaction Outputs (UTXOs), representing the remaining funds from previous transactions. When you send Bitcoin, you will spend these UTXOs.

- Amount: The quantity of cryptocurrency being transferred is an essential element of every transaction. It indicates the amount of digital assets being exchanged.

- ScriptSig: The term ‘script signature’ is an abbreviation for the process of encoding the public key and signature of the current owner of a Bitcoin (the payer).

- Signature: A transaction needs to be confirmed by the network before it can be put on the blockchain. To prove that they are the owner of the assets being transferred, the sender signs the transaction using their private key.

- Public Key: The corresponding public key to the signed private key. The network uses this public key to verify the validity of the signature.

Outputs are the newly generated Bitcoins locked to the hash of the public key of the payee.

- Recipient Address: The destination for the digital assets, known as the recipient’s address, is where they will be sent. Just like the sender’s address, it is derived from the recipient’s public key.

- ScriptPubKey: The locking script requires the recipient to provide evidence to spend the received Bitcoin. The ScriptPubKey is typically a Pay to Public Key Hash (P2PKH) script, requiring the recipient to provide a valid signature created with the corresponding private key.

Fees: Bitcoin transaction costs only depend on how big in bytes your transaction is. The more inputs and outputs you have, the more expensive your bitcoin fee will be.

How to Securely Send Bitcoin?

Keeping Private Keys Secure

Private keys play a vital role in securing digital currency, ensuring that only legitimate owners can access and use their assets. However, due to their sensitive nature, it is crucial to keep private keys safe and secure. Below, we will introduce three essential aspects to protect your private keys: Key generation, Key storage, and Key export.

Key Generation

- Use a good random source to generate keys.

- Encrypt the keys during transmission and store them when necessary.

- Monitor, authenticate, and authorize access to the keys.

Key Storage

- Use hardware-based protection mechanisms such as HSM for CA keys.

- Store end-entity keys in TPM or tamper-resistant USB devices.

- Use a cloud-based key storage repository provided by a trusted provider (if available).

- Use secure operating system key stores if hardware protection measures are not available.

Key Export

- Decide on key export based on risk, availability, and recovery capability.

- Encrypt the keys during export, both during transmission and storage.

- Use encryption methods that allow decryption when needed.

- End-entity keys usually do not need to be backed up and can be regenerated and reissued.

Avoid Phishing Attacks and Scams

Phishing scams are among the most common attacks on consumers. According to the FBI, more than 300,000 people fell victim to phishing scams in 2022. Collectively, those people turned over $52 million to scammers.

With the increasing popularity of Bitcoin, scams related to this cryptocurrency have become more sophisticated and have caused significant harm to users. Here are some common fraudulent schemes:

- Ponzi Schemes and High-Profit Investments: Beware of scams that promise excessively high profits in a short period. Fraudsters attract participants by offering high returns and using funds from new investors to pay initial investors. Eventually, when the scheme collapses, investors suffer significant losses.

- ICO Scams: ICO scams involve fraudulent initial coin offerings for non-existent or non-feasible cryptocurrency projects. Scammers create fake whitepapers, roadmaps, and misleading information to deceive investors and then abscond with the raised funds.

- Fake Exchange Scams: Scammers create fake Bitcoin exchanges to lure users into depositing funds, only to steal their assets. These fake exchanges often have attractive interfaces and appear legitimate initially, but they either disappear with the funds or lock users out of their accounts.

- Wallet Theft Scams: Fraudsters employ various methods, such as phishing or malware, to steal users’ Bitcoin wallet private keys. Once they have access to the private keys, they can easily withdraw the funds from the wallet.

To protect yourself and your assets, here are important tips to equip yourself with the knowledge to recognize and avoid common fraudulent schemes.

- Do thorough research: Before engaging in Bitcoin investment activities, do thorough research on the project, company, or exchange. Also, be cautious of unknown websites and projects lacking clear information about the development team, roadmap, whitepaper, etc.

- Use reputable wallets: Store your Bitcoin in reputable and secure wallets with high-level security features, such as hardware wallets or cold storage wallets.

- Secure personal information: Take care to protect your personal information, including your Bitcoin wallet’s private keys. Don’t share them with anyone and store them securely.

- Diversify your investment portfolio: Do not allocate more than 10% of your assets to a single project. Make sure to increase portfolio diversification to minimize risks.

Using Multi-signature Wallet

A useful method for keeping your Bitcoin wallet safe is to use a multi-signature (multi-sig) wallet. Multi-sig wallets have some advantages:

- Unlike a regular crypto wallet, a multi-sig wallet requires multiple private keys (usually two or more) to approve a transaction. It’s like needing multiple keys to open a safe – that’s the basic idea.

- When multiple signatures are needed, it becomes much harder for someone to steal your funds. Even if a hacker manages to get hold of one of your private keys, they won’t be able to take your cryptocurrency without the others.

- Multi-sig wallets are particularly useful when multiple people have ownership of the funds, like in a business or joint investment. This setup ensures that all parties must agree before a transaction can be carried out.

Updating Wallet Software

Regular updates of wallet software are crucial for maintaining strong security in your digital wallet. Updating your wallet software ensures that known vulnerabilities are fixed, making it harder for hackers to exploit weaknesses. An up-to-date wallet software means stronger encryption and better protection for your digital assets.

Improving Operating System

Operating system updates often include security patches that address flaws. By updating your operating system, you can prevent malware from gaining access to your device and potentially stealing your wallet information. However, it is also important to be aware of the latest tactics used by fraudsters, who exploit operating system updates to distribute malware.

Install Antivirus Software

Antivirus software helps detect and remove malware that may try to steal your wallet information. Regular system scans with updated antivirus software help identify and eliminate potential threats before they can cause harm.

By ensuring that all this software is up to date, you’re essentially fortifying your digital fortress. It becomes much more difficult for attackers to gain access to your valuable digital assets, as you’re closing the windows and locking the doors of your digital security.

Common Issues When Sending Bitcoin

Transaction Gets Stuck or Takes Too Long to Confirm

When the blockchain network is overloaded, there can be more pending transactions than the number of blocks that can be processed. This can lead to significant delays in some transactions being confirmed.

In addition, if you set a low transaction fee, miners may prioritize confirming transactions with higher fees. This can result in your transaction being delayed until enough miners are willing to confirm it.

How to avoid it:

- You may just need to wait and monitor the status of your transaction.

- Increasing the transaction fee can make your transaction more attractive to miners and help it get confirmed faster.

- If your transaction has an error, you can cancel it and try sending it again. However, note that canceling a transaction may incur fees.

- If you’ve tried all the above methods and your transaction is still congested, you can reach out to the support team of your wallet or exchange service for assistance.

Incorrect Recipient Address

This is the most serious mistake because Bitcoin transactions are irreversible.

Bitcoin addresses are very long numbers and can be confusing. If you enter the recipient’s wallet address incorrectly, even by just one wrong character, your Bitcoin will not be sent correctly.

How to avoid it:

- Double or triple-check the recipient’s address before confirming the transaction.

- Copy and paste the wallet address instead of manually typing it to minimize spelling errors.

- Use QR codes to obtain the recipient’s wallet address.

Insufficient Funds

While not as severe, this mistake can still be inconvenient. If you send the wrong amount of Bitcoin, you won’t receive the exact amount you intended. Or if you deposit more than the available amount, the system will not record it and will not allow you to leave.

How to avoid it:

- Double-check the amount you want to send before confirming the transaction.

- Use an on-screen keyboard when entering the amount to avoid inputting the wrong number.

- Test with a small amount first to carefully verify the transaction process.

How Long Does It Take to Send Bitcoin?

Bitcoin transfer speed is influenced by network congestion and transaction fees. Bitcoin’s transaction times can vary greatly, ranging anywhere from ten minutes to one day.

However, it will usually take between thirty minutes and two hours to complete the process. It’s important to remember that certain wallets and exchanges might require extra confirmations to finalize a transfer, which further extends the overall time.

The Bottom Line

CoinMinutes provides the most detailed explanation of how to send Bitcoin. However, it is important to understand the basic procedures to ensure a safe and efficient transaction. By following the steps outlined by CoinMinutes and maintaining the best practices, you can confidently send Bitcoin.