Bitcoin mining is a crucial process in the Bitcoin network. Miners will be rewarded with a certain number of Bitcoins after solving an algorithm and creating a new block to add to the chain.

To be able to mine Bitcoin, you have to spend a lot of money to invest in a mining rig as well as pay monthly electricity bills.

Miners also face difficulties when every 4 years the Bitcoin halving event takes place and causes the reward for mining Bitcoin to be halved. After the 2024 halving event, which took place on April 20, the reward for mining Bitcoin decreased from 6.25 to 3,125 BTC.

This creates a concern about whether Bitcoin mining is still profitable.

We believe Bitcoin mining is no longer profitable for you if you are a small miner. The investment cost for this is too large, and to capitalize, you will have to wait a long time until the price of Bitcoin increases.

Let’s analyze why Bitcoin mining is no longer profitable to understand more.

Key Takeaways

|

Is Bitcoin Mining Profitable?

Whether Bitcoin mining is profitable depends on various factors, including the cost of electricity, the price of Bitcoin, mining hardware efficiency, and operational expenses.

However, after the 2024 Bitcoin halving event, the reward for mining is only 3.125 BTC and the difficulty of the algorithms increases, making Bitcoin mining much more difficult. This means miners have to upgrade to better mining machines to have a chance to get Bitcoin.

With the huge costs that miners face, small Bitcoin mining is no longer profitable. Instead, Bitcoin mining has become the play of big mining companies with abundant financial resources.

Mining Difficulty

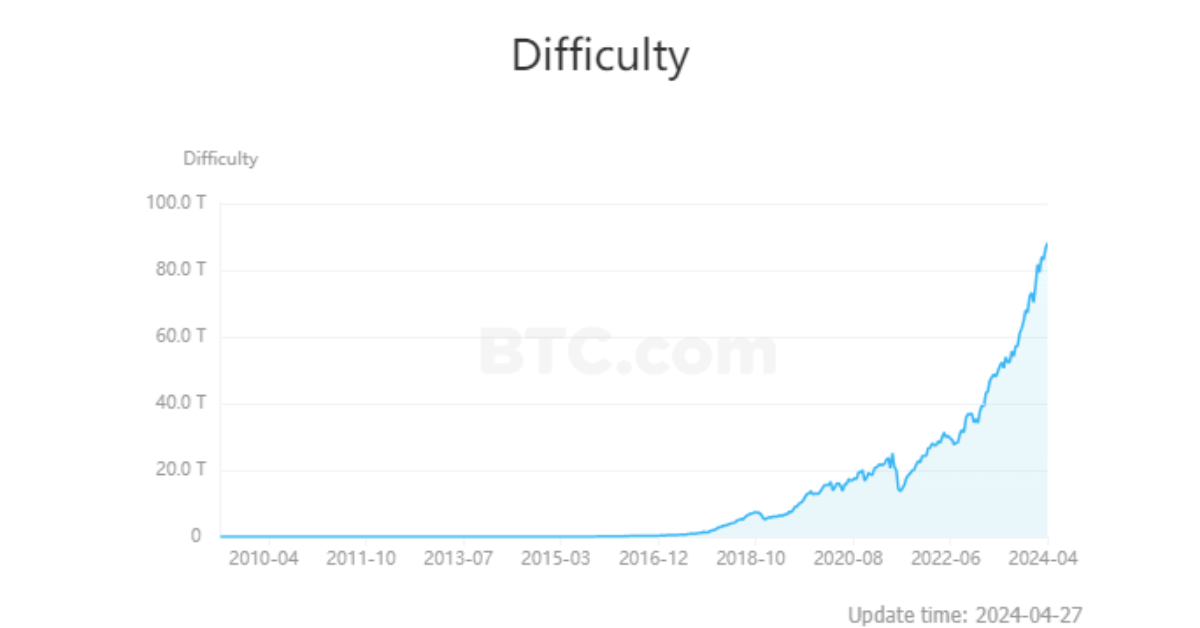

Not only has Bitcoin reached record-high prices, but its mining difficulty has also hit new highs. Data from BTC.com shows that on April 24, 2024, Bitcoin mining difficulty reached a record high of 88.10T with an average hash rate of 628.58 EH/s.[1]

From the above parameters, we can see that miners must perform 628.58 million attempts per second to process the algorithm and add a new block to the blockchain.

Moreover, this difficulty is continuously adjusted every 2016 block, or roughly every two weeks, to maintain a low block discovery rate.

With the increasing complexity of the algorithm, miners must upgrade their mining rigs to continue competing and have the opportunity to earn Bitcoin.

Mining Equipment Prices

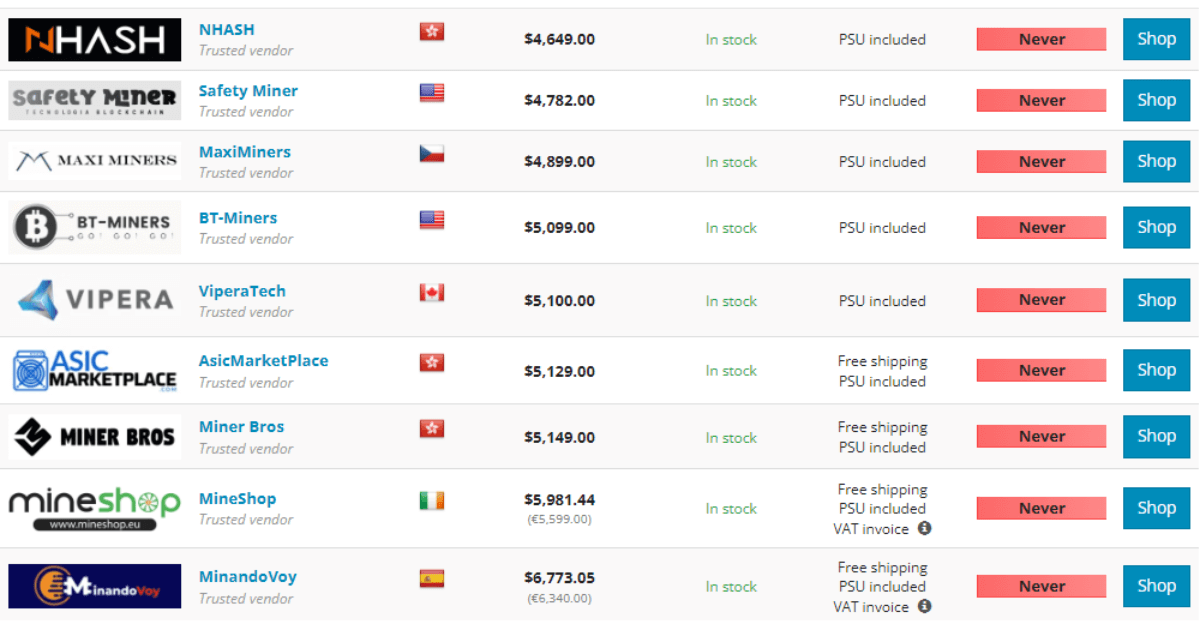

With record-high difficulty levels, Bitcoin miners are compelled to upgrade their computer systems with more powerful chips and higher hashing rates. The higher the hashing rate of a mining rig, the faster it can compute and have a better chance of receiving Bitcoin rewards.

However, top-performing mining rigs such as the Antminer S19 XP Hyd (255 TH/s) and MicroBT WhatsMiner M56S (212 TH/s) come with price tags ranging from $4,000 to $6,000 per device.

Not only are mining rigs becoming more expensive, but miners also need to be aware that mining Bitcoin consumes an enormous amount of electricity to computational and validate cryptocurrency transactions.

According to a study conducted by the U.S. Energy Information Administration (EIA), the energy consumed by Bitcoin mining ranged between 67 TWh to 240 TWh in 2023. This represents 0.2% to 0.9% of global energy consumption. To put this into perspective, the energy consumed by Bitcoin mining is equivalent to the total energy consumed by Greece and Australia, respectively.[2]

With the increasing difficulty of the algorithm, miners need to upgrade their mining rigs to newer machines to increase algorithm processing speed while reducing power consumption. If miners continue to use older generation miners, it will take longer to solve the algorithm, which means higher power consumption and a lower Bitcoin mining success rate.

Bitcoin Mining Reward

The reward for Bitcoin mining has now been reduced to 3.125 BTC for each successful block added to the chain. It will not stay the same but will continue to be halved every 4 years so mining Bitcoin will become more and more difficult. All miners are competing in an environment of investing more to mine less.

Lower Bitcoin Supply

From the outset, Bitcoin was designed with a limited supply cap of 21 million coins. As of now, around 19 million Bitcoins have been mined, meaning only 10% of the remaining supply is left to be evenly distributed among miners worldwide. This is also considered a factor driving Bitcoin mining difficulty to reach record levels.

As more people join the cryptocurrency mining race, especially large companies and organizations, put strong competition on the limited supply of bitcoin. Hence, Bitcoin mining can be less profitable if the Bitcoin price remains at its current level, or even declines as the cryptocurrency winter is predicted to approach.

What Is the Best Way to Mine Bitcoin?

Individual miners participating in Bitcoin mining are almost non-profitable as equipment investment has increased significantly while the rewards have halved compared to last year.

However, the strong increase in Bitcoin price, reaching new highs continuously, still attracts many investors to own the most valuable asset today. Therefore, Bitcoin miners need to have more reasonable mining options such as joining mining pools or using cloud mining.

Mining Pool

A mining pool is a group of cryptocurrency miners who combine their computing power to improve their chances of earning Bitcoin by collectively mining blocks. In doing so, the mining pool increases the chances of successfully mining a blockchain and distributes the rewards among its members based on their contributions.

These rewards are distributed proportionally according to each member’s contribution, processing power, or work compared to the entire pool.

- Supposedly your computer contributes a hashing power rate of 10 TH/s to the mining pool.

- 20 different miners are operating within the pool. Altogether, a hashing power equivalent to 200 TH/s is generated. This rate is 20 times higher than if you were mining independently.

- After a week, your pool successfully mines a Bitcoin block – that’s 3,125 BTC. Since you contributed 5% of the effort, you’ll receive 0.16 BTC.

The most significant of joining a mining pool is that you don’t have to be concerned about building an entire farm with hundreds of mining rigs to mine Bitcoin. Regardless of your hashing power, your devices still have a chance to mine Bitcoin as profits are shared based on contribution rates.

However, mining pools all charge participation fees, requiring you to pay a significant amount to be part of each pool. Additionally, the rewards for mining Bitcoin must be shared with many other participants.

Cloud Mining

Cloud mining is a new mechanism to mine Bitcoin, using rented cloud computing power without establishing and directly running the hardware and related software. Cloud mining can be a reasonable choice for those who don’t desire to invest in equipment or set up mining software themselves.

However, the major drawback of crypto cloud mining is the prevalence of scams. Many cloud mining services turn out to be fraudulent schemes designed to exploit investors. These scams promise high returns but fail to deliver, leaving investors with significant financial losses.

Before investing in cloud mining programs, investors should conduct thorough research and verify the legitimacy of providers to minimize risks.

The Bottom Line

Bitcoin mining has become increasingly challenging and less profitable for individual miners due to rising costs, reduced rewards, and intense competition. Alternative mining methods like joining mining pools or using cloud mining services may offer more viable options for those seeking to participate in Bitcoin mining.